Page 5 - BudgetBookCover_FY26_Adopted.pdf

P. 5

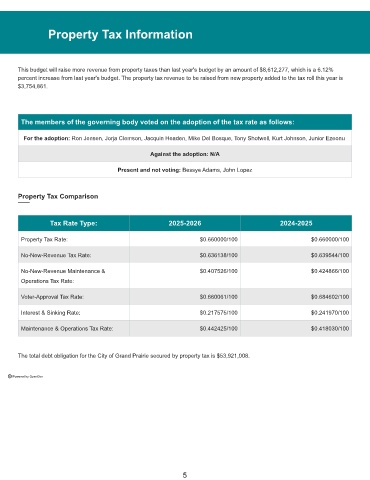

Property Tax Information

This budget will raise more revenue from property taxes than last year's budget by an amount of $8,612,277, which is a 6.12%

percent increase from last year's budget. The property tax revenue to be raised from new property added to the tax roll this year is

$3,754,861.

The members of the governing body voted on the adoption of the tax rate as follows:

For the adoption: Ron Jensen, Jorja Clemson, Jacquin Headen, Mike Del Bosque, Tony Shotwell, Kurt Johnson, Junior Ezeonu

Against the adoption: N/A

Present and not voting: Bessye Adams, John Lopez

Property Tax Comparison

Tax Rate Type: 2025-2026 2024-2025

Property Tax Rate: $0.660000/100 $0.660000/100

No-New-Revenue Tax Rate: $0.636138/100 $0.639544/100

No-New-Revenue Maintenance & $0.407526/100 $0.424866/100

Operations Tax Rate:

Voter-Approval Tax Rate: $0.660061/100 $0.684602/100

Interest & Sinking Rate: $0.217575/100 $0.241970/100

Maintenance & Operations Tax Rate: $0.442425/100 $0.418030/100

The total debt obligation for the City of Grand Prairie secured by property tax is $53,921,008.

Powered by OpenGov

5