Page 186 - BudgetBookCover_FY26_Adopted.pdf

P. 186

Tax Rate Limitation

All taxable property, within the City is subject to the assessment, levy and collection by the City of a continuing direct annual ad

valorem tax sufficient to provide for the payment of principal and interest on all ad valorem tax debt within the limits prescribed by law.

Article XI, Section 5, of the Texas Constitution is applicable to the City, and limits its maximum ad valorem tax rate to $2.50 per $100

Taxable Assessed Valuation of all City purposes. The Home Rule Charter of the City adopts the constitutionally authorized maximum

tax rate of $2.50 per $100 Taxable Assessed Valuation. The City of Grand Prairie’s adopted debt service levy is 0.241970 cents per

$100 Taxable Assessed Valuation for budget year 2025.

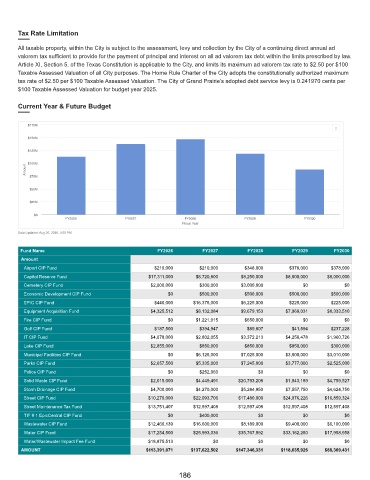

Current Year & Future Budget

$175M

$150M

$125M

Amount $100M

$75M

$50M

$25M

$0

FY2026 FY2027 FY2028 FY2029 FY2030

Fiscal Year

Data Updated: Aug 20, 2025, 4:00 PM

Fund Name FY2026 FY2027 FY2028 FY2029 FY2030

Amount

Airport CIP Fund $210,000 $210,000 $348,000 $378,000 $378,000

Capital Reserve Fund $17,311,000 $8,720,800 $8,250,000 $8,000,000 $8,000,000

Cemetery CIP Fund $2,000,000 $300,000 $3,000,000 $0 $0

Economic Development CIP Fund $0 $500,000 $500,000 $500,000 $500,000

EPIC CIP Fund $440,000 $16,375,000 $6,225,000 $225,000 $225,000

Equipment Acquisition Fund $4,325,512 $8,132,084 $9,679,153 $7,969,031 $8,333,510

Fire CIP Fund $0 $1,221,015 $650,000 $0 $0

Golf CIP Fund $187,500 $394,947 $89,807 $41,594 $237,228

IT CIP Fund $4,078,000 $2,802,055 $3,372,213 $4,258,478 $1,960,726

Lake CIP Fund $2,855,000 $850,000 $850,000 $850,000 $300,000

Municipal Facilities CIP Fund $0 $6,125,000 $7,025,000 $3,000,000 $3,010,000

Parks CIP Fund $2,657,500 $5,335,000 $7,245,000 $3,777,000 $2,525,000

Police CIP Fund $0 $252,960 $0 $0 $0

Solid Waste CIP Fund $2,015,000 $4,449,491 $20,793,208 $1,943,189 $4,759,527

Storm Drainage CIP Fund $4,700,000 $4,270,000 $5,284,950 $7,557,750 $4,624,750

Street CIP Fund $10,270,000 $22,093,706 $17,480,000 $24,976,226 $16,859,324

Street Maintenance Tax Fund $13,751,407 $12,597,408 $12,597,408 $12,597,408 $12,597,408

TIF # 1 EpicCentral CIP Fund $0 $400,000 $0 $0 $0

Wastewater CIP Fund $12,460,139 $16,600,000 $8,189,000 $9,400,000 $6,100,000

Water CIP Fund $17,254,500 $25,993,036 $35,767,592 $33,162,250 $17,958,958

Water/Wastewater Impact Fee Fund $18,875,513 $0 $0 $0 $0

AMOUNT $113,391,071 $137,622,502 $147,346,331 $118,635,926 $88,369,431

186