Page 30 - CityofForestHillFY26Budget

P. 30

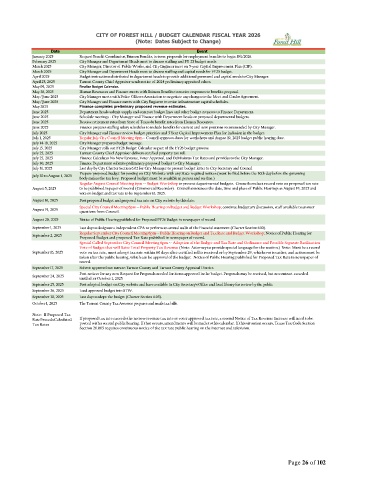

CITY OF FOREST HILL / BUDGET CALENDAR FISCAL YEAR 2026

(Note: Dates Subject to Change)

Date Event

January 2025 Request Benefit Coordinator, Brinson Benefits, to issue proposals for employment benefits to begin 10/1/2026.

February 2025 City Manager and Department Heads meet to discuss staffing and FY 25 budget needs.

March 2025 City Manager, Director of Public Works, and City Engineer meet on 5-year Capital Improvement Plan (CIP).

March 2025 City Manager and Department Heads meet to discuss staffing and capital needs for FY25 budget.

April 2025 Budget instructions distributed to department heads to provide additional personnel and capital needs to City Manager.

April 25, 2025 Tarrant County Chief Appraiser sends notice of 2024 preliminary appraised values.

May 09, 2025 Finalize Budget Calendar.

May 30, 2025 Human Resources and Finance meets with Brinson Benefits to receive responses to benefits proposal.

May / June 2025 City Manager meets with Police Officers Association to negotiate any changes to the Meet and Confer Agreement.

May / June 2025 City Manager and Finance meets with City Engineer to revise infrastructure capital schedules.

May 2025 Finance completes preliminary proposed revenue estimates.

June 2025 Department heads submit supply and contract budget lines and other budget requests to Finance Department.

June 2025 Schedule meetings - City Manager and Finance with Department heads on proposed departmental budgets.

June 2025 Receive retirement rates from State of Texas & benefit rates from Human Resources.

June 2025 Finance prepares staffing salary schedules to include benefits for current and new positions recommended by City Manager.

July 2025 City Manager and Finance review budget priorities and 5 Year Capital Improvement Plan for inclusion in the budget.

July 1, 2025 Regular July City Council Meeting 6pm-- Council approves dates for workshops and August 19, 2025 budget public hearing date.

July 14-18, 2025 City Manager prepares budget message.

July 15, 2025 City Manager rolls out FY26 Budget Calendar as part of the FY26 budget process.

July 25, 2025 Tarrant County Chief Appraiser delivers certified property tax roll.

July 25, 2025 Finance Calculates No New Revenue, Voter Approval, and DeMinimus Tax Rates and provides to the City Manager.

July 30, 2025 Finance Department submits preliminary proposed budget to City Manager.

July 31, 2025 Last day by City Charter Section 6.02 for City Manager to present budget letter to City Secretary and Council

Prepare proposed budget for posting on City Website with any State required notices (must be filed before the 30th day before the governing

July 30 to August 1, 2025

body makes the tax levy. Proposed budget must be available in person and on-line.)

Regular August Council Meeting 6pm -- Budget Workshop to present departmental budgets. Council conduct record vote on proposed tax rate

August 5, 2025 to be published in paper of record (Commercial Recorder). Council announces the date, time and place of Public Hearings as August 19, 2025 and

vote on budget and tax rate to be September 16, 2025.

August 16, 2025 Post proposed budget and proposed tax rate on City website by this date.

Special City Council Meeting 6pm -- Public Hearing on Budget and Budget Workshop; continue budgetary discussion, staff available to answer

August 19, 2025 questions from Council.

August 20, 2025 Notice of Public Hearing published for Proposed FY26 Budget in newspaper of record

September 1, 2025 Last day to designate a independent CPA to perform an annual audit of the financial statement (Charter Section 6.10).

Regular September City Council Meeting 6pm -- Public Hearing on Budget and Tax Rate and Budget Workshop; Notice of Public Hearing for

September 2, 2025

Proposed Budget and proposed Tax Rate pubished in newspaper of record.

Special Called September City Council Meeting 6pm -- Adoption of the Budget and Tax Rate and Ordinance and Possible Separate Ratification

Vote of Budget that will Raise Total Property Tax Revenue (Note: Attorney to provide special language for the motion.) Note: Must be a record

September 16, 2025 vote on tax rate, must adoopt tax rate within 60 days after certified roll is received or by September 29, whichever is earlier, and action must be

taken after the public hearing, which can be approval of the budget. Notice of Public Hearing published for Proposed Tax Rate in newspaper of

record.

September 17, 2025 Submit approved tax rates to Tarrant County and Tarrant County Appraisal District.

Post notices for any new Request for Proposals needed for items approved in the budget. Proposals may be received, but no contract awarded

September 24, 2025

until after October 1, 2025.

September 25, 2025 Post adopted budget on City website and have available in City Secretary's Office and local library for review by the public

September 26, 2025 Load approved budget into STW.

September 30, 2025 Last day to adopt the budget (Charter Section 6.05).

October 1, 2025 The Tarrant County Tax Assessor prepares and mails tax bills.

Note: If Proposed Tax

Rate Exceeds Calculated If proposed tax rate exceeds the no new revenue tax rate or voter approved tax rate, a second Notice of Tax Revenue Increase will need to be

Tax Rates posted with a second public hearing. If that occurs, amendments will be made to this calendar. If this situation occurs, Texas Tax Code Section

Section 26.065 requires continuous notice of the tax rate public hearing on the internet and television.

Page 26 of 102