Page 104 - CityofForestHillFY26Budget

P. 104

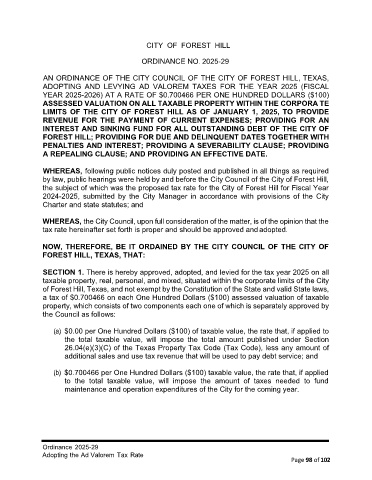

CITY OF FOREST HILL

ORDINANCE NO. 2025-29

AN ORDINANCE OF THE CITY COUNCIL OF THE CITY OF FOREST HILL, TEXAS,

ADOPTING AND LEVYING AD VALOREM TAXES FOR THE YEAR 2025 (FISCAL

YEAR 2025-2026) AT A RATE OF $0.700466 PER ONE HUNDRED DOLLARS ($100)

ASSESSED VALUATION ON ALL TAXABLE PROPERTY WITHIN THE CORPORA TE

LIMITS OF THE CITY OF FOREST HILL AS OF JANUARY 1, 2025, TO PROVIDE

REVENUE FOR THE PAYMENT OF CURRENT EXPENSES; PROVIDING FOR AN

INTEREST AND SINKING FUND FOR ALL OUTSTANDING DEBT OF THE CITY OF

FOREST HILL; PROVIDING FOR DUE AND DELINQUENT DATES TOGETHER WITH

PENALTIES AND INTEREST; PROVIDING A SEVERABILITY CLAUSE; PROVIDING

A REPEALING CLAUSE; AND PROVIDING AN EFFECTIVE DATE.

WHEREAS, following public notices duly posted and published in all things as required

by law, public hearings were held by and before the City Council of the City of Forest Hill,

the subject of which was the proposed tax rate for the City of Forest Hill for Fiscal Year

2024-2025, submitted by the City Manager in accordance with provisions of the City

Charter and state statutes; and

WHEREAS, the City Council, upon full consideration of the matter, is of the opinion that the

tax rate hereinafter set forth is proper and should be approved and adopted.

NOW, THEREFORE, BE IT ORDAINED BY THE CITY COUNCIL OF THE CITY OF

FOREST HILL, TEXAS, THAT:

SECTION 1. There is hereby approved, adopted, and levied for the tax year 2025 on all

taxable property, real, personal, and mixed, situated within the corporate limits of the City

of Forest Hill, Texas, and not exempt by the Constitution of the State and valid State laws,

a tax of $0.700466 on each One Hundred Dollars ($100) assessed valuation of taxable

property, which consists of two components each one of which is separately approved by

the Council as follows:

(a) $0.00 per One Hundred Dollars ($100) of taxable value, the rate that, if applied to

the total taxable value, will impose the total amount published under Section

26.04(e)(3)(C) of the Texas Property Tax Code (Tax Code), less any amount of

additional sales and use tax revenue that will be used to pay debt service; and

(b) $0.700466 per One Hundred Dollars ($100) taxable value, the rate that, if applied

to the total taxable value, will impose the amount of taxes needed to fund

maintenance and operation expenditures of the City for the coming year.

Ordinance 2025-29

Adopting the Ad Valorem Tax Rate

Page 98 of 102