Page 88 - ClearGov | Documents

P. 88

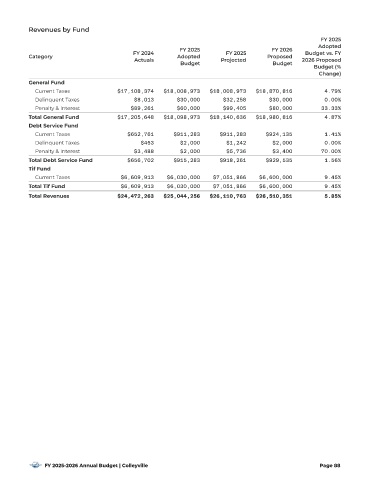

Revenues by Fund

FY 2025

Adopted

FY 2025 FY 2026

FY 2024 FY 2025 Budget vs. FY

Category Adopted Proposed

Actuals Projected 2026 Proposed

Budget Budget

Budget (%

Change)

General Fund

Current Taxes $17,108,374 $18,008,973 $18,008,973 $18,870,816 4.79%

Delinquent Taxes $8,013 $30,000 $32,258 $30,000 0.00%

Penalty & Interest $89,261 $60,000 $99,405 $80,000 33.33%

Total General Fund $17,205,648 $18,098,973 $18,140,636 $18,980,816 4.87%

Debt Ser vice Fund

Current Taxes $652,761 $911,283 $911,283 $924,135 1.41%

Delinquent Taxes $453 $2,000 $1,242 $2,000 0.00%

Penalty & Interest $3,488 $2,000 $5,736 $3,400 70.00%

Total Debt Ser vice Fund $656,702 $915,283 $918,261 $929,535 1.56%

Tif Fund

Current Taxes $6,609,913 $6,030,000 $7,051,866 $6,600,000 9.45%

Total Tif Fund $6,609,913 $6,030,000 $7,051,866 $6,600,000 9.45%

Total Revenues $24,472,263 $25,044,256 $26,110,763 $26,510,351 5.85%

FY 2025-2026 Annual Budget | Colleyville Page 88