Page 17 - CityofBurlesonFY26Budget

P. 17

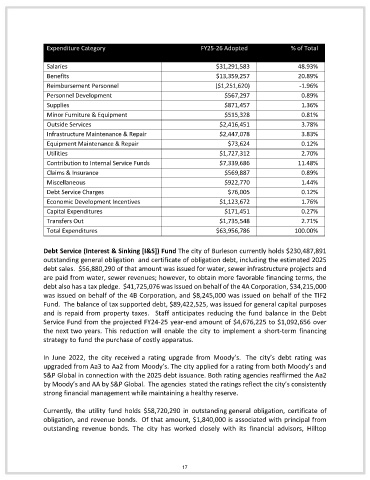

Expenditure Category FY25-26 Adopted % of Total

Salaries $31,291,583 48.93%

Benefits $13,359,257 20.89%

Reimbursement Personnel ($1,251,620) -1.96%

Personnel Development $567,297 0.89%

Supplies $871,457 1.36%

Minor Furniture & Equipment $515,328 0.81%

Outside Services $2,416,451 3.78%

Infrastructure Maintenance & Repair $2,447,078 3.83%

Equipment Maintenance & Repair $73,624 0.12%

Utilities $1,727,312 2.70%

Contribution to Internal Service Funds $7,339,686 11.48%

Claims & Insurance $569,887 0.89%

Miscellaneous $922,770 1.44%

Debt Service Charges $76,005 0.12%

Economic Development Incentives $1,123,672 1.76%

Capital Expenditures $171,451 0.27%

Transfers Out $1,735,548 2.71%

Total Expenditures $63,956,786 100.00%

Debt Service (Interest & Sinking [I&S]) Fund The city of Burleson currently holds $230,487,891

outstanding general obligation and certificate of obligation debt, including the estimated 2025

debt sales. $56,880,290 of that amount was issued for water, sewer infrastructure projects and

are paid from water, sewer revenues; however, to obtain more favorable financing terms, the

debt also has a tax pledge. $41,725,076 was issued on behalf of the 4A Corporation, $34,215,000

was issued on behalf of the 4B Corporation, and $8,245,000 was issued on behalf of the TIF2

Fund. The balance of tax supported debt, $89,422,525, was issued for general capital purposes

and is repaid from property taxes. Staff anticipates reducing the fund balance in the Debt

Service Fund from the projected FY24-25 year-end amount of $4,676,225 to $1,092,656 over

the next two years. This reduction will enable the city to implement a short-term financing

strategy to fund the purchase of costly apparatus.

In June 2022, the city received a rating upgrade from Moody’s. The city’s debt rating was

upgraded from Aa3 to Aa2 from Moody’s. The city applied for a rating from both Moody’s and

S&P Global in connection with the 2025 debt issuance. Both rating agencies reaffirmed the Aa2

by Moody’s and AA by S&P Global. The agencies stated the ratings reflect the city’s consistently

strong financial management while maintaining a healthy reserve.

Currently, the utility fund holds $58,720,290 in outstanding general obligation, certificate of

obligation, and revenue bonds. Of that amount, $1,840,000 is associated with principal from

outstanding revenue bonds. The city has worked closely with its financial advisors, Hilltop

17