Page 53 - FY 2021-22 ADOPTED BUDGET

P. 53

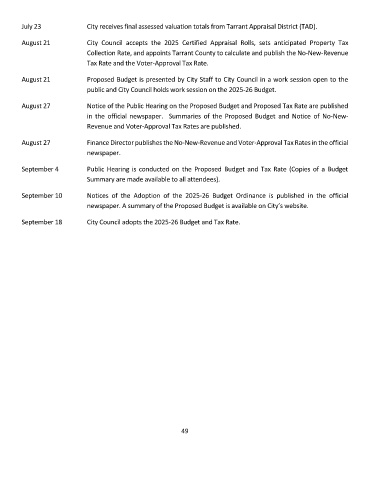

July 23 City receives final assessed valuation totals from Tarrant Appraisal District (TAD).

August 21 City Council accepts the 2025 Certified Appraisal Rolls, sets anticipated Property Tax

Collection Rate, and appoints Tarrant County to calculate and publish the No-New-Revenue

Tax Rate and the Voter-Approval Tax Rate.

August 21 Proposed Budget is presented by City Staff to City Council in a work session open to the

public and City Council holds work session on the 2025-26 Budget.

August 27 Notice of the Public Hearing on the Proposed Budget and Proposed Tax Rate are published

in the official newspaper. Summaries of the Proposed Budget and Notice of No-New-

Revenue and Voter-Approval Tax Rates are published.

August 27 Finance Director publishes the No-New-Revenue and Voter-Approval Tax Rates in the official

newspaper.

September 4 Public Hearing is conducted on the Proposed Budget and Tax Rate (Copies of a Budget

Summary are made available to all attendees).

September 10 Notices of the Adoption of the 2025-26 Budget Ordinance is published in the official

newspaper. A summary of the Proposed Budget is available on City’s website.

September 18 City Council adopts the 2025-26 Budget and Tax Rate.

49