Page 29 - FY 2021-22 ADOPTED BUDGET

P. 29

being cautious and projected sales tax to be the same as the prior year. The City in 2021-22 began the construction

of a new municipal complex with an economy is experiencing high inflation and the potential of a recession. As a

result of these challenges, the 2025-26 Budget is very lean and essentially flat from the prior year with NO decision

packages approved.

BALANCING THE BUDGET

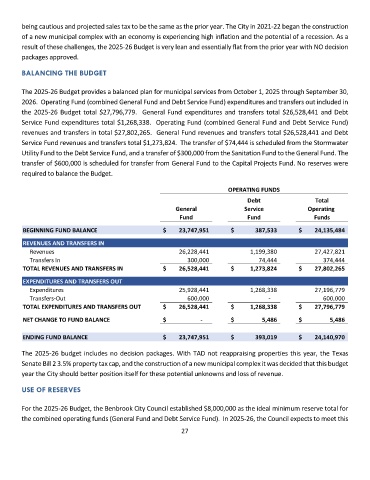

The 2025-26 Budget provides a balanced plan for municipal services from October 1, 2025 through September 30,

2026. Operating Fund (combined General Fund and Debt Service Fund) expenditures and transfers out included in

the 2025-26 Budget total $27,796,779. General Fund expenditures and transfers total $26,528,441 and Debt

Service Fund expenditures total $1,268,338. Operating Fund (combined General Fund and Debt Service Fund)

revenues and transfers in total $27,802,265. General Fund revenues and transfers total $26,528,441 and Debt

Service Fund revenues and transfers total $1,273,824. The transfer of $74,444 is scheduled from the Stormwater

Utility Fund to the Debt Service Fund, and a transfer of $300,000 from the Sanitation Fund to the General Fund. The

transfer of $600,000 is scheduled for transfer from General Fund to the Capital Projects Fund. No reserves were

required to balance the Budget.

OPERATING FUNDS

Debt Total

General Service Operating

Fund Fund Funds

BEGINNING FUND BALANCE $ 23,747,951 $ 387,533 $ 24,135,484

REVENUES AND TRANSFERS IN

Revenues 26,228,441 1,199,380 27,427,821

Transfers In 300,000 74,444 374,444

TOTAL REVENUES AND TRANSFERS IN $ 26,528,441 $ 1,273,824 $ 27,802,265

EXPENDITURES AND TRANSFERS OUT

Expenditures 25,928,441 1,268,338 27,196,779

Transfers-Out 600,000 - 600,000

TOTAL EXPENDITURES AND TRANSFERS OUT $ 26,528,441 $ 1,268,338 $ 27,796,779

NET CHANGE TO FUND BALANCE $ - $ 5,486 $ 5,486

ENDING FUND BALANCE $ 23,747,951 $ 393,019 $ 24,140,970

The 2025-26 budget includes no decision packages. With TAD not reappraising properties this year, the Texas

Senate Bill 2 3.5% property tax cap, and the construction of a new municipal complex it was decided that this budget

year the City should better position itself for these potential unknowns and loss of revenue.

USE OF RESERVES

For the 2025-26 Budget, the Benbrook City Council established $8,000,000 as the ideal minimum reserve total for

the combined operating funds (General Fund and Debt Service Fund). In 2025-26, the Council expects to meet this

27