Page 623 - Bedford-FY25-26 Budget

P. 623

Return to Truth in Taxation

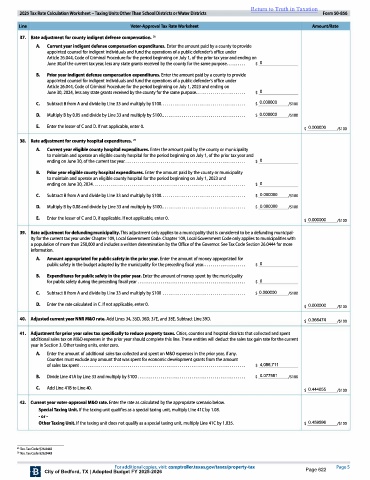

2025 Tax Rate Calculation Worksheet- Taxing Units Other Than School Districts or Water Districts FormS0-856

Line Voter-Approval Tax Rate Worksheet Amount/Rate

37. Rate adjustment for county indigent defense compensation. 28

A. Current year indigent defense compensation expenditures. Enter the amount paid by a county to provide

appointed counsel for indigent individuals and fund the operations of a public defender's office under

Article 26.044, Code of Criminal Procedure for the period beginning on July 1, of the prior tax year and ending on

June 30,of the current tax year , less any state grants received by the county for the same purpose .......... s 0

B. Prior year indigent defense compensation expenditures. Enter the amount paid by a county to provide

appointed counsel for indigent individuals and fund the operations of a public defender's office under

Article 26.044, Code of Criminal Procedure for the period beginning on July 1, 2023 and ending on

June 30, 2024, less any state grants received by the county for the same purpose .......................... s 0

C. Subtract B from A and divide by Line 33 and multiply by $100 ............................................ S 0.000000 /$100

D. Multiply B by 0. 05 and divide by Line 33 and multiply by $100 .......................................... S 0.000000 /$100

.

.

E. Enter the lesser of C and D. If not applicable , enter 0. 0.000000

$ /$100

38. Rate adjustment for county hospital expenditures. 29

A. Current year eligible county hospital expenditures. Enter the amount paid by the county or municipality

to maintain and operate an eligible county hospital for the period beginning on July 1, of the prior tax year and

ending on June 30, of the current tax year ............................................................... s 0

B. Prior year eligible county hospital expenditures. Enter the amount paid by the county or municipality

to maintain and operate an eligible county hospital for the period beginning on July 1, 2023 and

ending on June 30, 2024 . ............................................................................. s 0

.

C. Subtract B from A and divide by Line 33 and multiply by $100 ............................................ s 0.000000 /$100

D. Multiply B by 0. 08 and divide by Line 33 and multiply by $100 .......................................... $ 0.000000 /$100

.

.

E. Enter the lesser of C and D , if applicable. If not applicable , enter 0 . $ 0.000000 /$100

39. Rate adjustment for defunding municipality. This adjustment only applies to a municipality that is considered to be a defunding municipal-

ity for the current tax year under Chapter 109, Local Government Code. Chapter 109, Local Government Code only applies to municipalities with

a population of more than 250, 000 and includes a written determination by the Office of the Governor. See Tax Code Section 26.0444 for more

information.

A. Amount appropriated for public safety in the prior year. Enter the amount of money appropriated for

public safety in the budget adopted by the municipality for the preceding fiscal year ...................... s 0

B. Expenditures for public safety in the prior year. Enter the amount of money spent by the municipality

for public safety during the preceding fiscal year ........................................................ S 0

C. Subtract B from A and divide by Line 33 and multiply by $100 ........................................... $ 0.000000 /$100

D. Enter the rate calculated in C. If not applicable , enter 0 . 0.000000

$ /$100

40. Adjusted current year NNR M&O rate. Add Lines 34, 35D , 36 D , 37E , and 38E. Subtract Line 39D. 0.366474

$ /$100

41. Adjustment for prior year sales tax specifically to reduce property taxes. Cities , counties and hospital districts that collected and spent

additional sales tax on M&O expenses in the prior year should complete this line. These entities will deduct the sales tax gain rate for the current

year in Section 3. Other taxing units , enter zero.

A. Enter the amount of additional sales tax collected and spent on M&O expenses in the prior year , if any.

Counties must exclude any amount that was spent for economic development grants from the amount

of sales tax spent ...................................................................................... S 4,086,711

B. Divide Line 41 A by Line 33 and multiply by $100 ........................................................ $ 0.077581 /$100

C. Add Line 41B to Line 40. $ 0.444055 /$100

42. Current year voter-approval M&O rate. Enter the rate as calculated by the appropriate scenario below.

Special Taxing Unit. If the taxing unit qualifies as a special taxing unit , multiply Line 41 C by 1. 08.

- o r-

Other Taxing Unit. If the taxing unit does not qualify as a special taxing unit , multiply Line 41C by 1 .035. $ 0.459596 /$100

2 8 Tex. Tax Code §26.0442

2 9 Tex. Tax Code §26.0443

For additional copies , visit: comptroller.texas.gov/taxes/property-tax Pages

City of Bedford, TX | Adopted Budget FY 2025-2026 Page 622