Page 223 - Bedford-FY25-26 Budget

P. 223

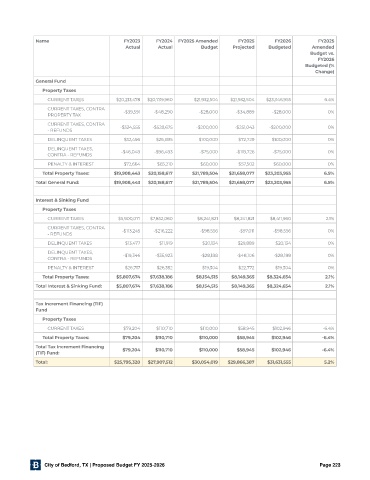

Name FY2023 FY2024 FY2025 Amended FY2025 FY2026 FY2025

Actual Actual Budget Projected Budgeted Amended

Budget vs.

FY2026

Budgeted (%

Change)

General Fund

Property Taxes

CURRENT TAXES $20,213,478 $20,739,960 $21,932,504 $21,932,504 $23,346,955 6.4%

CURRENT TAXES, CONTRA -$39,591 -$48,290 -$28,000 -$34,889 -$28,000 0%

PROPERTY TAX

CURRENT TAXES, CONTRA -$324,555 -$528,675 -$200,000 -$251,043 -$200,000 0%

- REFUNDS

DELINQUENT TAXES $32,496 $26,895 $100,000 $72,729 $100,000 0%

DELINQUENT TAXES, -$46,048 -$96,483 -$75,000 -$118,726 -$75,000 0%

CONTRA - REFUNDS

PENALTY & INTEREST $72,664 $65,210 $60,000 $57,502 $60,000 0%

Total Property Taxes: $19,908,443 $20,158,617 $21,789,504 $21,658,077 $23,203,955 6.5%

Total General Fund: $19,908,443 $20,158,617 $21,789,504 $21,658,077 $23,203,955 6.5%

Interest & Sinking Fund

Property Taxes

CURRENT TAXES $5,900,071 $7,852,060 $8,241,821 $8,241,821 $8,411,960 2.1%

CURRENT TAXES, CONTRA -$113,245 -$216,222 -$98,556 -$97,011 -$98,556 0%

- REFUNDS

DELINQUENT TAXES $13,477 $11,919 $20,134 $29,889 $20,134 0%

DELINQUENT TAXES, -$19,346 -$35,923 -$28,188 -$48,106 -$28,188 0%

CONTRA - REFUNDS

PENALTY & INTEREST $26,717 $26,352 $19,304 $22,772 $19,304 0%

Total Property Taxes: $5,807,674 $7,638,186 $8,154,515 $8,149,365 $8,324,654 2.1%

Total Interest & Sinking Fund: $5,807,674 $7,638,186 $8,154,515 $8,149,365 $8,324,654 2.1%

Tax Increment Financing (TIF)

Fund

Property Taxes

CURRENT TAXES $79,204 $110,710 $110,000 $58,945 $102,946 -6.4%

Total Property Taxes: $79,204 $110,710 $110,000 $58,945 $102,946 -6.4%

Total Tax Increment Financing

$79,204 $110,710 $110,000 $58,945 $102,946 -6.4%

(TIF) Fund:

Total: $25,795,320 $27,907,512 $30,054,019 $29,866,387 $31,631,555 5.2%

City of Bedford, TX | Proposed Budget FY 2025-2026 Page 223