Page 249 - CityofArlingtonFY26AdoptedBudget

P. 249

Appendices

FINANCIAL POLICIES (CONTINUED)

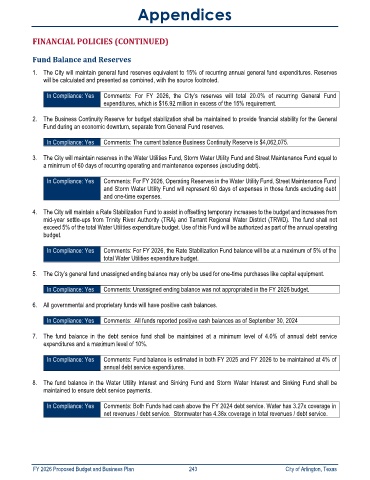

Fund Balance and Reserves

1. The City will maintain general fund reserves equivalent to 15% of recurring annual general fund expenditures. Reserves

will be calculated and presented as combined, with the source footnoted.

In Compliance: Yes Comments: For FY 2026, the City’s reserves will total 20.0% of recurring General Fund

expenditures, which is $16.92 million in excess of the 15% requirement.

2. The Business Continuity Reserve for budget stabilization shall be maintained to provide financial stability for the General

Fund during an economic downturn, separate from General Fund reserves.

In Compliance: Yes Comments: The current balance Business Continuity Reserve is $4,062,075.

3. The City will maintain reserves in the Water Utilities Fund, Storm Water Utility Fund and Street Maintenance Fund equal to

a minimum of 60 days of recurring operating and maintenance expenses (excluding debt).

In Compliance: Yes Comments: For FY 2026, Operating Reserves in the Water Utility Fund, Street Maintenance Fund

and Storm Water Utility Fund will represent 60 days of expenses in those funds excluding debt

and one-time expenses.

4. The City will maintain a Rate Stabilization Fund to assist in offsetting temporary increases to the budget and increases from

mid-year settle-ups from Trinity River Authority (TRA) and Tarrant Regional Water District (TRWD). The fund shall not

exceed 5% of the total Water Utilities expenditure budget. Use of this Fund will be authorized as part of the annual operating

budget.

In Compliance: Yes Comments: For FY 2026, the Rate Stabilization Fund balance will be at a maximum of 5% of the

total Water Utilities expenditure budget.

5. The City’s general fund unassigned ending balance may only be used for one-time purchases like capital equipment.

In Compliance: Yes Comments: Unassigned ending balance was not appropriated in the FY 2026 budget.

6. All governmental and proprietary funds will have positive cash balances.

In Compliance: Yes Comments: All funds reported positive cash balances as of September 30, 2024

7. The fund balance in the debt service fund shall be maintained at a minimum level of 4.0% of annual debt service

expenditures and a maximum level of 10%.

In Compliance: Yes Comments: Fund balance is estimated in both FY 2025 and FY 2026 to be maintained at 4% of

annual debt service expenditures.

8. The fund balance in the Water Utility Interest and Sinking Fund and Storm Water Interest and Sinking Fund shall be

maintained to ensure debt service payments.

In Compliance: Yes Comments: Both Funds had cash above the FY 2024 debt service. Water has 3.27x coverage in

net revenues / debt service. Stormwater has 4.38x coverage in total revenues / debt service.

FY 2026 Proposed Budget and Business Plan 243 City of Arlington, Texas