Page 134 - TownofWestlakeFY25BudgetOrd1005

P. 134

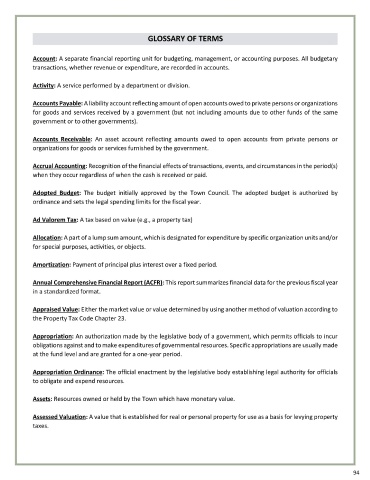

GLOSSARY OF TERMS

Account: A separate financial reporting unit for budgeting, management, or accounting purposes. All budgetary

transactions, whether revenue or expenditure, are recorded in accounts.

Activity: A service performed by a department or division.

Accounts Payable: A liability account reflecting amount of open accounts owed to private persons or organizations

for goods and services received by a government ( but not including amounts due to other funds of the same

government or to other governments).

Accounts Receivable: An asset account reflecting amounts owed to open accounts from private persons or

organizations for goods or services furnished by the government.

Accrual Accounting: Recognition of the financial effects of transactions, events, and circumstances in the period(s)

when they occur regardless of when the cash is received or paid.

Adopted Budget: The budget initially approved by the Town Council. The adopted budget is authorized by

ordinance and sets the legal spending limits for the fiscal year.

Ad Valorem Tax: A tax based on value (e.g., a property tax)

Allocation: A part of a lump sum amount, which is designated for expenditure by specific organization units and/ or

for special purposes, activities, or objects.

Amortization: Payment of principal plus interest over a fixed period.

Annual Comprehensive Financial Report (ACFR): This report summarizes financial data for the previous fiscal year

in a standardized format.

Appraised Value: Either the market value or value determined by using another method of valuation according to

the Property Tax Code Chapter 23.

Appropriation: An authorization made by the legislative body of a government, which permits officials to incur

obligations against and to make expenditures of governmental resources. Specific appropriations are usually made

at the fund level and are granted for a one-year period.

Appropriation Ordinance: The official enactment by the legislative body establishing legal authority for officials

to obligate and expend resources.

Assets: Resources owned or held by the Town which have monetary value.

Assessed Valuation: A value that is established for real or personal property for use as a basis for levying property

taxes.

94