Page 366 - CityofWataugaAdoptedBudgetFY25

P. 366

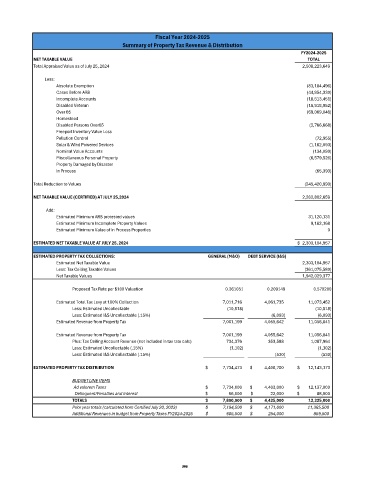

Fiscal Year 2024-2025

Summary of Property Tax Revenue & Distribution

FY2024-2025

NET TAXABLE VALUE TOTAL

Total Appraised Value as of July 25, 2024 2,508,223,649

Less:

Absolute Exemption (83,184,496)

Cases Before ARB (44,954,330)

Incomplete Accounts (18,513,451)

Disabled Veteran (18,918,952)

Over 65 (69,069,046)

Homestead

Disabled Persons Over65 (2,766,668)

Freeport Inventory Value Loss

Pollution Control (72,955)

Solar & Wind Powered Devices (1,162,093)

Nominal Value Accounts (134,080)

Miscellaneous Personal Property (6,579,526)

Property Damaged by Disaster

In Process (65,393)

Total Reduction to Values (245,420,990)

NET TAXABLE VALUE (CERTIFIED) AT JULY 25,2024 2,262,802,659

Add:

Estimated Minimum ARB protested values 31,120,131

Estimated Minimum Incomplete Property Values 9,182,168

Estimated Minimum Value of In Process Properties 0

ESTIMATED NET TAXABLE VALUE AT JULY 25, 2024 $ 2,303,104,957

ESTIMATED PROPERTY TAX COLLECTIONS: GENERAL (M&O) DEBT SERVICE (I&S)

Estimated Net Taxable Value 2,303,104,957

Less: Tax Ceiling Taxable Values (361,075,580)

Net Taxable Values 1,942,029,377

Proposed Tax Rate per $100 Valuation 0.361051 0.209149 0.570200

Estimated Total Tax Levy at 100% Collection 7,011,716 4,061,735 11,073,452

Less: Estimated Uncollectable (10,518) (10,518)

Less: Estimated I&S Uncollectable (.15%) (6,093) (6,093)

Estimated Revenue from Property Tax 7,001,199 4,055,642 11,056,841

Estimated Revenue from Property Tax 7,001,199 4,055,642 11,056,841

Plus: Tax Ceiling Account Revenue (not included in tax rate calc) 734,376 353,588 1,087,964

Less: Estimated Uncollectable (.15%) (1,102) (1,102)

Less: Estimated I&S Uncollectable (.15%) (530) (530)

ESTIMATED PROPERTY TAX DISTRIBUTION $ 7,734,473 $ 4,408,700 $ 12,143,173

BUDGET LINE ITEMS

Ad valorem Taxes $ 7,734,000 $ 4,403,000 $ 12,137,000

Delinquent/Penalties and Interest $ 66,000 $ 22,000 $ 88,000

TOTALS $ 7,800,000 $ 4,425,000 12,225,000

Prior year totals (calculated from Certified July 20, 2023) $ 7,194,500 $ 4,171,000 11,365,500

Additional Revenues in budget from Property Taxes FY2024-2025 $ 605,500 $ 254,000 859,500

256

346