Page 293 - CityofSouthlakeFY25AdoptedBudget

P. 293

Community Enhancement and Development Corporation

(CEDC) Fund

The Community Enhancement and Development Corporation was formed

when Southlake voters approved the special levy of a 3/8 cent sales tax in

DID YOU 2015. The funds are dedicated toward the construction of Champions Club at

KNOW? The Marq Southlake, a community events and recreation facility. Funds will

DID YOU

KNOW? also be used to support operational expenses related to The Marq as well as

CEDC - OPERATING FUND

special economic development projects. Special Revenue Funds

Parks/Recreation

2025 Proposed and 2024 Revised Budget

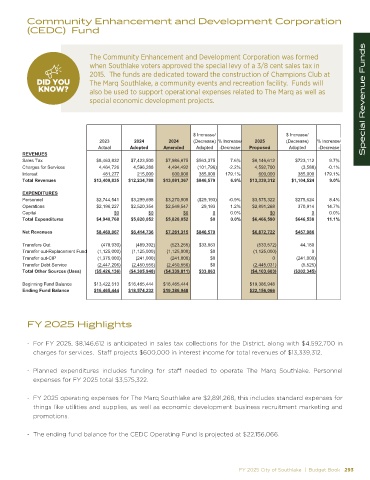

$ Increase/ $ Increase/

2023 2024 2024 (Decrease) % Increase/ 2025 (Decrease) % Increase/

Actual Adopted Amended Adopted -Decrease Proposed Adopted -Decrease

REVENUES

Sales Tax $8,463,832 $7,423,500 $7,986,875 $563,375 7.6% $8,146,612 $723,112 9.7%

Charges for Services 4,464,726 4,596,288 4,494,492 (101,796) -2.2% 4,592,700 (3,588) -0.1%

Interest 481,277 215,000 600,000 385,000 179.1% 600,000 385,000 179.1%

Total Revenues $13,409,835 $12,234,788 $13,081,367 $846,579 6.9% $13,339,312 $1,104,524 9.0%

EXPENDITURES

Personnel $2,744,541 $3,299,698 $3,270,505 ($29,193) -0.9% $3,575,322 $275,624 8.4%

Operations $2,196,227 $2,520,354 $2,549,547 29,193 1.2% $2,891,268 370,914 14.7%

Capital $0 $0 $0 0 0.0% $0 0 0.0%

Total Expenditures $4,940,768 $5,820,052 $5,820,052 $0 0.0% $6,466,590 $646,538 11.1%

Net Revenues $8,469,067 $6,414,736 $7,261,315 $846,579 $6,872,722 $457,986

Transfers Out (478,930) (489,392) (523,255) $33,863 (533,572) 44,180

Transfer out-Replacement Fund (1,125,000) (1,125,000) (1,125,000) $0 (1,125,000) 0

Transfer out-CIP (1,375,000) (241,000) (241,000) $0 0 (241,000)

Transfer Debt Service (2,447,206) (2,450,556) (2,450,556) $0 (2,445,031) (5,525)

Total Other Sources (Uses) ($5,426,136) ($4,305,948) ($4,339,811) $33,863 ($4,103,603) ($202,345)

Beginning Fund Balance $13,422,513 $16,465,444 $16,465,444 $19,386,948

Ending Fund Balance $16,465,444 $18,574,232 $19,386,948 $22,156,066

FY 2025 Highlights

- For FY 2025, $8,146,612 is anticipated in sales tax collections for the District, along with $4,592,700 in

charges for services. Staff projects $600,000 in interest income for total revenues of $13,339,312.

- Planned expenditures includes funding for staff needed to operate The Marq Southlake. Personnel

expenses for FY 2025 total $3,575,322.

- FY 2025 operating expenses for The Marq Southlake are $2,891,268, this includes standard expenses for

things like utilities and supplies, as well as economic development business recruitment marketing and

promotions.

- The ending fund balance for the CEDC Operating Fund is projected at $22,156,066.

FY 2025 City of Southlake | Budget Book 293