Page 70 - CityofSaginawFY25Budget

P. 70

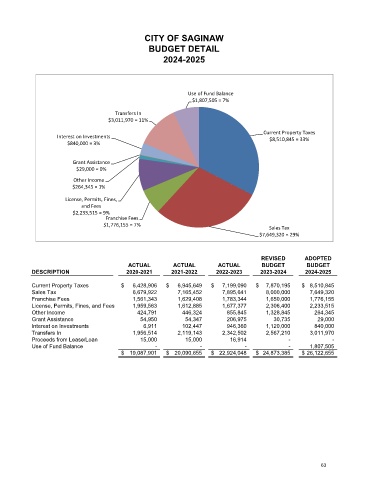

CITY OF SAGINAW

BUDGET DETAIL

2024-2025

Use of Fund Balance

$1,807,505 = 7%

Transfers In

$3,011,970 = 11%

Current Property Taxes

Interest on Investments $8,510,845 = 33%

$840,000 = 3%

Grant Assistance

$29,000 = 0%

Other Income

$264,345 = 1%

License, Permits, Fines,

and Fees

$2,233,515 = 9%

Franchise Fees

$1,776,155 = 7%

Sales Tax

$7,649,320 = 29%

REVISED ADOPTED

ACTUAL ACTUAL ACTUAL BUDGET BUDGET

DESCRIPTION 2020-2021 2021-2022 2022-2023 2023-2024 2024-2025

Current Property Taxes $ 6,428,906 $ 6,945,649 $ 7,199,090 $ 7,870,195 $ 8,510,845

Sales Tax 6,679,922 7,165,452 7,895,641 8,000,000 7,649,320

Franchise Fees 1,561,343 1,629,408 1,783,344 1,650,000 1,776,155

License, Permits, Fines, and Fees 1,959,563 1,612,885 1,677,377 2,306,400 2,233,515

Other Income 424,791 446,324 855,845 1,328,845 264,345

Grant Assistance 54,950 54,347 206,975 30,735 29,000

Interest on Investments 6,911 102,447 946,360 1,120,000 840,000

Transfers In 1,956,514 2,119,143 2,342,502 2,567,210 3,011,970

Proceeds from Lease/Loan 15,000 15,000 16,914 - -

Use of Fund Balance - - - - 1,807,505

$ 19,087,901 $ 20,090,655 $ 22,924,048 $ 24,873,385 $ 26,122,655

63