Page 1 - TownofPantegoFY25Budget

P. 1

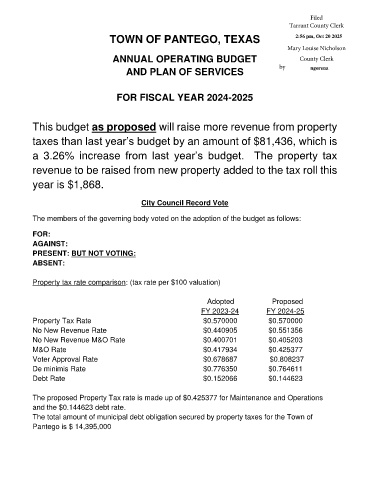

Filed

Tarrant County Clerk

TOWN OF PANTEGO, TEXAS 2:56 pm, Oct 20 2025

Mary Louise Nicholson

ANNUAL OPERATING BUDGET County Clerk

by ngorena

AND PLAN OF SERVICES

FOR FISCAL YEAR 2024-2025

This budget as proposed will raise more revenue from property

taxes than last year’s budget by an amount of $81,436, which is

a 3.26% increase from last year’s budget. The property tax

revenue to be raised from new property added to the tax roll this

year is $1,868.

City Council Record Vote

The members of the governing body voted on the adoption of the budget as follows:

FOR:

AGAINST:

PRESENT: BUT NOT VOTING:

ABSENT:

Property tax rate comparison: (tax rate per $100 valuation)

Adopted Proposed

FY 2023-24 FY 2024-25

Property Tax Rate $0.570000 $0.570000

No New Revenue Rate $0.440905 $0.551356

No New Revenue M&O Rate $0.400701 $0.405203

M&O Rate $0.417934 $0.425377

Voter Approval Rate $0.678687 $0.808237

De minimis Rate $0.776350 $0.764611

Debt Rate $0.152066 $0.144623

The proposed Property Tax rate is made up of $0.425377 for Maintenance and Operations

and the $0.144623 debt rate.

The total amount of municipal debt obligation secured by property taxes for the Town of

Pantego is $ 14,395,000