Page 64 - CityofMansfieldFY25Budget

P. 64

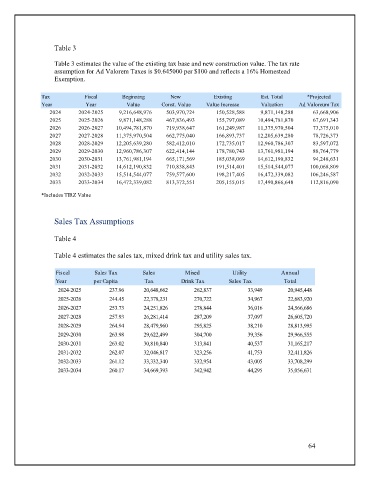

Table 3

Table 3 estimates the value of the existing tax base and new construction value. The tax rate

assumption for Ad Valorem Taxes is $0.645000 per $100 and reflects a 16% Homestead

Exemption.

Tax Fiscal Beginning New Existing Est. Total *Projected

Year Year Value Const. Value Value Increase Valuation Ad Valoreum Tax

2024 2024-2025 9,216,648,976 503,970,724 150,528,588 9,871,148,288 63,668,906

2025 2025-2026 9,871,148,288 467,836,493 155,797,089 10,494,781,870 67,691,343

2026 2026-2027 10,494,781,870 719,938,647 161,249,987 11,375,970,504 73,375,010

2027 2027-2028 11,375,970,504 662,775,040 166,893,737 12,205,639,280 78,726,373

2028 2028-2029 12,205,639,280 582,412,010 172,735,017 12,960,786,307 83,597,072

2029 2029-2030 12,960,786,307 622,414,144 178,780,743 13,761,981,194 88,764,779

2030 2030-2031 13,761,981,194 665,171,569 185,038,069 14,612,190,832 94,248,631

2031 2031-2032 14,612,190,832 710,838,843 191,514,401 15,514,544,077 100,068,809

2032 2032-2033 15,514,544,077 759,577,600 198,217,405 16,472,339,082 106,246,587

2033 2033-2034 16,472,339,082 813,372,551 205,155,015 17,490,866,648 112,816,090

*Includes TIRZ Value

Sales Tax Assumptions

Table 4

Table 4 estimates the sales tax, mixed drink tax and utility sales tax.

Fiscal Sales Tax Sales Mixed Utility Annual

Year per Capita Tax Drink Tax Sales Tax Total

2024-2025 237.96 20,648,662 262,837 33,949 20,945,448

2025-2026 244.45 22,378,231 270,722 34,967 22,683,920

2026-2027 253.73 24,251,826 278,844 36,016 24,566,686

2027-2028 257.93 26,281,414 287,209 37,097 26,605,720

2028-2029 264.94 28,479,960 295,825 38,210 28,813,995

2029-2030 263.98 29,622,499 304,700 39,356 29,966,555

2030-2031 263.02 30,810,840 313,841 40,537 31,165,217

2031-2032 262.07 32,046,817 323,256 41,753 32,411,826

2032-2033 261.12 33,332,340 332,954 43,005 33,708,299

2033-2034 260.17 34,669,393 342,942 44,295 35,056,631

64