Page 43 - CityofLakeWorthFY25AdoptedBudget

P. 43

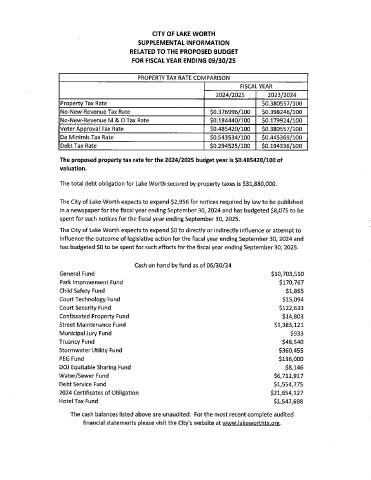

CITY OF LAKE WORTH

SUPPLEMENTAL INFORMATION

RELATED TO THE PROPOSED BUDGET

FOR FISCAL YEAR ENDING 09/ 30/ 25

PROPERTY TAX RATE COMPARISON

FISCAL YEAR

2024/ 2025 2023/ 2024

Property Tax Rate 0. 380557/ 100

No -New -Revenue Tax Rate 0,376996/ 100 0. 398246/ 100

No -New -Revenue M & O Tax Rate 0. 184440/ 100 0. 179924/ 100

Voter Approval Tax Rate 09485420/ 100 0.380557/ 100

De Minimis Tax Rate 0.543534/ 100 06445369/ 100

Debt Tax Rate 0, 294525/ 100 00194336/ 100

The proposed property tax rate for the 2024/ 2025 budget year is $ 0.485420/ 100 of

valuation.

The total debt obligation for Lake Worth secured by property taxes is $ 31,880,000.

The City of Lake Worth expects to expend $2,956 for notices required by law to be published

in a newspaper for the fiscal year ending September 30, 2024 and has budgeted $8,075 to be

spent for such notices for the fiscal year ending September 30, 2025.

The City of Lake Worth expects to expend $0 to directly or indirectly influence or attempt to

influence the outcome of legislative action for the fiscal year ending September 30, 2024 and

has budgeted $0 to be spent for such efforts for the fiscal year ending September 30, 2025.

Cash on hand by fund as of 06/ 30/ 24

General Fund $ 10, 703,510

Park Improvement Fund $ 170,767

Child Safety Fund $ 1, 865

Court Technology Fund $ 15, 094

Court Security Fund $ 122, 633

Confiscated Property Fund $ 14,803

Street Maintenance Fund $ 1, 383, 121

Municipal Jury Fund $ 933

Truancy Fund $ 48,540

Stormwater Utility Fund $ 360,455

PEG Fund $ 136,000

DOJ Equitable Sharing Fund $ 8, 146

Water/ Sewer Fund $ 6, 7121917

Debt Service Fund $ 1, 554,775

2024 Certificates of Obligation $ 21, 654, 127

Hotel Tax Fund $ 1, 547,698

The cash balances listed above are unaudited. For the most recent complete audited

financial statements please visit the City's website at www.lakeworthtx.ore.