Page 11 - CityofHasletFY25AnnualBudget

P. 11

CITY OF HASLET

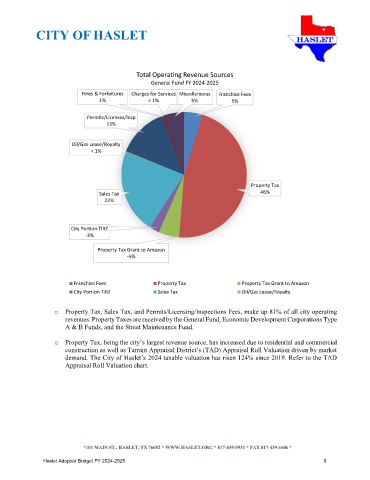

Total Operating Revenue Sources

General Fund FY 2024-2025

Fines & Forfeitures Charges for Services Miscellaneous Franchise Fees

1% < 1% 5% 5%

Permits/Licenses/Insp

13%

Oil/Gas Lease/Royalty

< 1%

Property Tax

Sales Tax 46%

22%

City Portion TIRZ

-3%

Property Tax Grant to Amazon

-5%

Franchise Fees Property Tax Property Tax Grant to Amazon

City Portion TIRZ Sales Tax Oil/Gas Lease/Royalty

o Property Tax, Sales Tax, and Permits/Licensing/Inspections Fees, make up 81% of all city operating

revenues. Property Taxes are received by the General Fund, Economic Development Corporations Type

A & B Funds, and the Street Maintenance Fund.

o Property Tax, being the city’s largest revenue source, has increased due to residential and commercial

construction as well as Tarrant Appraisal District’s (TAD) Appraisal Roll Valuation driven by market

demand. The City of Haslet’s 2024 taxable valuation has risen 124% since 2019. Refer to the TAD

Appraisal Roll Valuation chart.

*101 MAIN ST., HASLET, TX 76052 * WWW.HASLET.ORG * 817-439-5931 * FAX 817-439-1606 *

Haslet Adopted Budget FY 2024-2025 9