Page 67 - CityofGrapevineFY25AdoptedBudget

P. 67

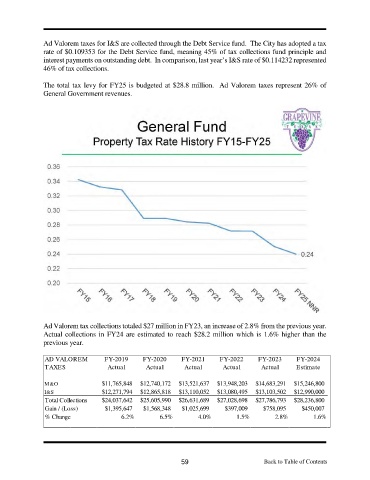

Ad Valorem taxes for I&S are collected through the Debt Service fund. The City has adopted a tax

rate of $0.109353 for the Debt Service fund, meaning 45% of tax collections fund principle and

interest payments on outstanding debt. In comparison, last year’s I&S rate of $0.114232 represented

46% of tax collections.

The total tax levy for FY25 is budgeted at $28.8 million. Ad Valorem taxes represent 26% of

General Government revenues.

Ad Valorem tax collections totaled $27 million in FY23, an increase of 2.8% from the previous year.

Actual collections in FY24 are estimated to reach $28.2 million which is 1.6% higher than the

previous year.

AD VALOREM FY-2019 FY-2020 FY-2021 FY-2022 FY-2023 FY-2024

TAXES Actual Actual Actual Actual Actual Estimate

M&O $11,765,848 $12,740,172 $13,521,637 $13,948,203 $14,683,291 $15,246,800

I&S $12,271,794 $12,865,818 $13,110,052 $13,080,495 $13,103,502 $12,990,000

Total Collections $24,037,642 $25,605,990 $26,631,689 $27,028,698 $27,786,793 $28,236,800

Gain / (Loss) $1,395,647 $1,568,348 $1,025,699 $397,009 $758,095 $450,007

% Change 6.2% 6.5% 4.0% 1.5% 2.8% 1.6%

59 Back to Table of Contents

of

Contents

Back

Back to Table of Contents

Table

to