Page 281 - CityofGrapevineFY25AdoptedBudget

P. 281

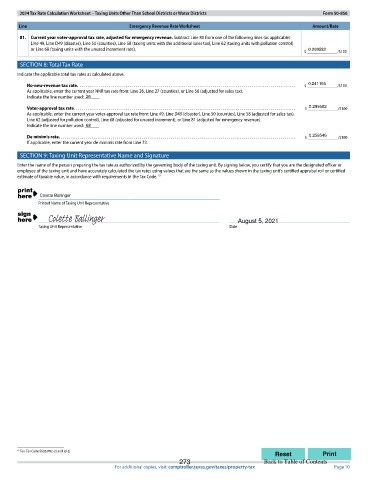

2024 Tax Rate Calculation Worksheet – Taxing Units Other Than School Districts or Water Districts Form 50-856

Line Emergency Revenue Rate Worksheet Amount/Rate

81. Current year voter-approval tax rate, adjusted for emergency revenue. Subtract Line 80 from one of the following lines (as applicable):

Line 49, Line D49 (disaster), Line 50 (counties), Line 58 (taxing units with the additional sales tax), Line 62 (taxing units with pollution control)

or Line 68 (taxing units with the unused increment rate). $ __________/$100

0.299582

SECTION 8: Total Tax Rate

Indicate the applicable total tax rates as calculated above.

0.241165

No-new-revenue tax rate. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ __________/$100

.

As applicable, enter the current year NNR tax rate from: Line 26, Line 27 (counties), or Line 56 (adjusted for sales tax).

Indicate the line number used: ______

26

0.299582

Voter-approval tax rate. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ __________/$100

As applicable, enter the current year voter-approval tax rate from: Line 49, Line D49 (disaster), Line 50 (counties), Line 58 (adjusted for sales tax),

Line 62 (adjusted for pollution control), Line 68 (adjusted for unused increment), or Line 81 (adjusted for emergency revenue).

Indicate the line number used: ______

68

0.259546

De minimis rate. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ __________/$100

If applicable, enter the current year de minimis rate from Line 73.

SECTION 9: Taxing Unit Representative Name and Signature

Enter the name of the person preparing the tax rate as authorized by the governing body of the taxing unit. By signing below, you certify that you are the designated officer or

employee of the taxing unit and have accurately calculated the tax rates using values that are the same as the values shown in the taxing unit’s certified appraisal roll or certified

estimate of taxable value, in accordance with requirements in the Tax Code. 52

____________________________________________________________

Colette Ballinger

Printed Name of Taxing Unit Representative

____________________________________________________________ ________________________________________

August 5, 2021

Taxing Unit Representative Date

52 Tex. Tax Code §§26.04(c-2) and (d-2)

Reset Print

273 Back to Table of Contents

Contents

of

Back to Table of Contents

Back

Table

to

For additional copies, visit: comptroller.texas.gov/taxes/property-tax Page 10