Page 2 - CityofGrapevineFY25AdoptedBudget

P. 2

City of Grapevine

Fiscal Year 2024-2025

Budget Cover Page

September 17, 2024

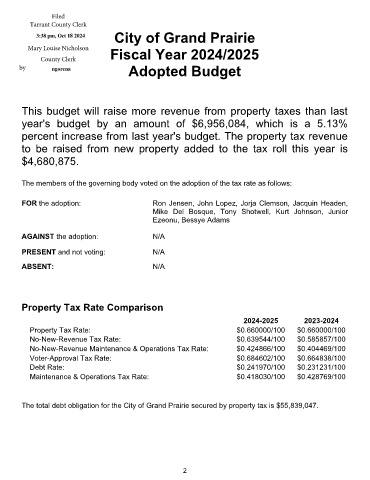

This budget will raise more revenue from property taxes than last year's

budget by an amount of $86,789, which is a 0.33 percent increase from

last year's budget. The property tax revenue to be raised from new

property added to the tax roll this year is $132,503.

The members of the governing body voted on the budget as follows:

FOR: William D. Tate Darlene Freed

Chris Coy Duff O'Dell

Paul Slechta Sharron Rogers

Leon Leal

AGAINST:

PRESENT and not voting:

ABSENT:

Property Tax Rate Comparison

2024-2025 2023-2024

Property Tax Rate: $0.241165/100 $0.250560/100

No-New-Revenue Tax Rate: $0.241165/100 $0.250560/100

No-New-Revenue Maintenance & Operations Tax Rate: $0.145601/100 $0.146090/100

Voter-Approval Tax Rate: $0.299582/100 $0.265435/100

Debt Rate: $0.109353/100 $0.114232/100

Total debt obligation for City of Grapevine secured by property taxes: $11,904,724