Page 181 - City of Fort Worth Budget Book

P. 181

Debt Service Funds General Debt Service

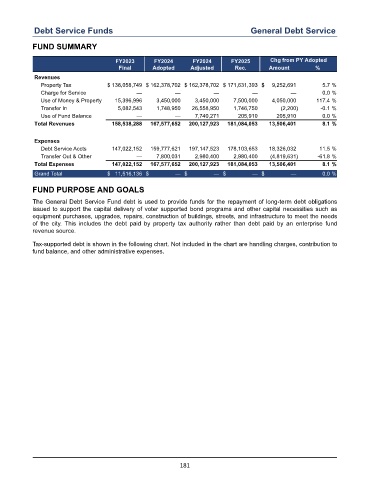

FUND SUMMARY

FY2023 FY2024 FY2024 FY2025 Chg from PY Adopted

Final Adopted Adjusted Rec. Amount %

Revenues

Property Tax $ 138,058,749 $ 162,378,702 $ 162,378,702 $ 171,631,393 $ 9,252,691 5.7 %

Charge for Service — — — — — 0.0 %

Use of Money & Property 15,396,996 3,450,000 3,450,000 7,500,000 4,050,000 117.4 %

Transfer In 5,082,543 1,748,950 26,558,950 1,746,750 (2,200) -0.1 %

Use of Fund Balance — — 7,740,271 205,910 205,910 0.0 %

Total Revenues 158,538,288 167,577,652 200,127,923 181,084,053 13,506,401 8.1 %

Expenses

Debt Service Accts 147,022,152 159,777,621 197,147,523 178,103,653 18,326,032 11.5 %

Transfer Out & Other — 7,800,031 2,980,400 2,980,400 (4,819,631) -61.8 %

Total Expenses 147,022,152 167,577,652 200,127,923 181,084,053 13,506,401 8.1 %

Grand Total $ 11,516,136 $ — $ — $ — $ — 0.0 %

FUND PURPOSE AND GOALS

The General Debt Service Fund debt is used to provide funds for the repayment of long-term debt obligations

issued to support the capital delivery of voter supported bond programs and other capital necessities such as

equipment purchases, upgrades, repairs, construction of buildings, streets, and infrastructure to meet the needs

of the city. This includes the debt paid by property tax authority rather than debt paid by an enterprise fund

revenue source.

Tax-supported debt is shown in the following chart. Not included in the chart are handling charges, contribution to

fund balance, and other administrative expenses.

181