Page 38 - CityofForestHillFY25AdoptedBudget

P. 38

AD VALOREM TAXES – PROPOSED RATE

This budget is built on a tax rate of $.724094 per $100 valuation. This is the same as last year’s adopted

tax rate. The no new revenue tax rate is based on a tax rate that would produce the same amount if

applied to the same properties taxed in both years with an increment of 3.5%. For the FY 2025 year, the

no new revenue rate calculated by the City is $.695028 per $100 of assessed valuation. Because the City

has less than 30,000 residents, it is allowed to calculate the de minimis rate, which is the no new revenue

rate plus the tax rate that would raise an additional $500,000. The FY 2025 de minimis rate is $.743743.

Since the proposed tax rate of $.724094 is less than the de minimis rate of .743743 and the rate that

would be calculated as a special taxing district ($.751189) under Section 26.075 of the Texas Tax Code,

the voters may not petition the City to hold an election for a lower tax rate. The rate of $.724094 per

$100 valuation is the maintenance and operations (M&O) rate as the City has a $0.000000 interest and

sinking (I&S) rate (for FY 25 due to having ample funds in the Debt Service Fund to pay the bonded debt

for FY 2025.

AD VALOREM TAXES -- COLLECTIONS

For fiscal year 2025, the property tax levy will amount to an estimated $7,270,775 an increase of 1.93%

over the previous fiscal year’s tax levy amount of $7,133,313. The City has a contract with the Tarrant

County Tax Assessor Collector’s Office for the billing and collection of ad valorem taxes.

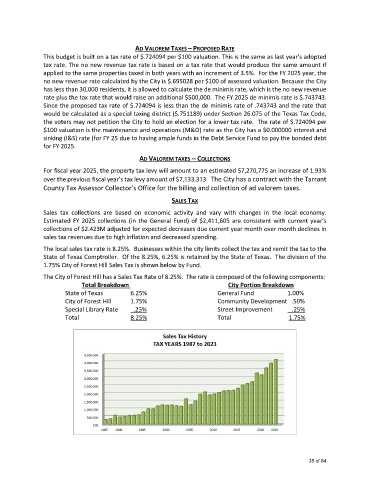

SALES TAX

Sales tax collections are based on economic activity and vary with changes in the local economy.

Estimated FY 2025 collections (in the General Fund) of $2,411,605 are consistent with current year’s

collections of $2.423M adjusted for expected decreases due current year month over month declines in

sales tax revenues due to high inflation and decreased spending.

The local sales tax rate is 8.25%. Businesses within the city limits collect the tax and remit the tax to the

State of Texas Comptroller. Of the 8.25%, 6.25% is retained by the State of Texas. The division of the

1.75% City of Forest Hill Sales Tax is shown below by Fund.

The City of Forest Hill has a Sales Tax Rate of 8.25%. The rate is composed of the following components:

Total Breakdown City Portion Breakdown

State of Texas 6.25% General Fund 1.00%

City of Forest Hill 1.75% Community Development .50%

Special Library Rate .25% Street Improvement .25%

Total 8.25% Total 1.75%

35 of 84