Page 5 - CityofDalworthingtonGardensFY25AdoptedBudget

P. 5

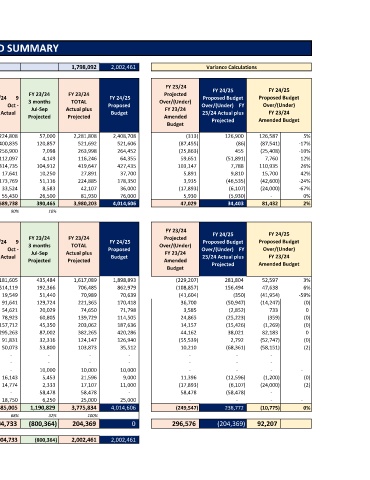

110-GENERAL FUND SUMMARY

BEGINNING FUND BALANCE 741,192 1,369,771 2,049,858 1,798,092 1,798,092 2,002,461 Variance Calculations

FY 23/24

FY 23/24 FY 23/24 Projected FY 24/25 FY 24/25

FY 23/24 FY 23/24 9 FY 24/25 Proposed Budget Proposed Budget

TOTAL

REVENUE CATEGORY FY 20/21 Actual FY 21/22 Actual FY 22/23 Actual Amended months Oct - 3 months Actual plus Proposed Over/(Under) Over/(Under) FY Over/(Under)

FY 23/24

Jul-Sep

Budget Jun Actual Budget 23/24 Actual plus FY 23/24

Projected Projected Amended

Budget Projected Amended Budget

Property Tax 1,870,062 1,974,301 2,202,416 2,282,121 2,224,808 57,000 2,281,808 2,408,708 (313) 126,900 126,587 5%

Sales & Use Tax 560,931 597,111 581,401 609,147 400,835 120,857 521,692 521,606 (87,455) (86) (87,541) -17%

Franchise Fees 312,868 287,538 290,513 289,861 256,900 7,098 263,998 264,452 (25,863) 455 (25,408) -10%

Licenses & Permits 63,449 80,294 73,634 56,595 112,097 4,149 116,246 64,355 59,651 (51,891) 7,760 12%

Fines & Fees 375,586 333,577 328,700 316,500 314,735 104,912 419,647 427,435 103,147 7,788 110,935 26%

Service Charges & Fees 84,713 14,560 15,805 22,000 17,641 10,250 27,891 37,700 5,891 9,810 15,700 42%

Other Revenue 353,451 320,898 167,026 220,950 173,769 51,116 224,885 178,350 3,935 (46,535) (42,600) -24%

Gas Royalties 149,714 218,198 86,085 60,000 33,524 8,583 42,107 36,000 (17,893) (6,107) (24,000) -67%

Other Financing Sources 19,021 97,731 89,655 76,000 55,430 26,500 81,930 76,000 5,930 (5,930) - 0%

TOTAL REVENUE 3,789,794 3,924,207 3,835,235 3,933,174 3,589,738 390,465 3,980,203 4,014,606 47,029 34,403 81,432 2%

90% 10%

FY 23/24 FY 24/25

FY 23/24 FY 23/24 Projected FY 24/25

FY 23/24 FY 23/24 9 FY 24/25 Proposed Budget Proposed Budget

TOTAL

EXPENDITURE CATEGORY FY 20/21 Actual FY 21/22 Actual FY 22/23 Actual Amended months Oct - 3 months Actual plus Proposed Over/(Under) Over/(Under) FY Over/(Under)

FY 23/24

Jul-Sep

Budget Jun Actual Budget 23/24 Actual plus FY 23/24

Projected Projected Amended Projected Amended Budget

Budget

Personnel Salary & Wages 1,449,474 1,418,445 1,627,192 1,846,296 1,181,605 435,484 1,617,089 1,898,893 (229,207) 281,804 52,597 3%

Personnel Taxes & Benefits 638,744 572,358 666,767 815,341 514,119 192,366 706,485 862,979 (108,857) 156,494 47,638 6%

Training & Travel 25,180 20,846 34,353 112,593 19,549 51,440 70,989 70,639 (41,604) (350) (41,954) -59%

Materials & Supplies 147,043 120,053 121,064 184,664 91,641 129,724 221,365 170,418 36,700 (50,947) (14,247) (0)

Utilities 66,584 65,260 69,510 71,065 54,621 20,029 74,650 71,798 3,585 (2,852) 733 0

Maintenance 69,454 84,668 93,611 114,864 78,923 60,805 139,729 114,505 24,865 (25,223) (359) (0)

Consultants 171,485 201,810 201,103 188,905 157,712 45,350 203,062 187,636 14,157 (15,426) (1,269) (0)

Contractual 248,922 261,271 284,365 338,103 295,263 87,002 382,265 420,286 44,162 38,021 82,183 0

Other Expenses 112,923 98,654 147,287 179,686 91,831 32,316 124,147 126,940 (55,539) 2,792 (52,747) (0)

Capital Outlay 68,645 78,689 25,857 93,663 50,073 53,800 103,873 35,512 10,210 (68,361) (58,151) (2)

Transfer to Enterprise - - 5,187 - - - - - - - -

Transfer to PRFDC - - 20,532 - - - - - - - -

Transfer to CCPD - 9,200 - 10,000 - 10,000 10,000 10,000 - - - -

Transfer to DPS Complex - 100,000 607,272 10,200 16,143 5,453 21,596 9,000 11,396 (12,596) (1,200) (0)

Transfer to Gas Reserve 137,762 165,867 113,901 35,000 14,774 2,333 17,107 11,000 (17,893) (6,107) (24,000) (2)

Transfer to GF Capital Fund - Tasers - - - - - 58,478 58,478 - 58,478 (58,478) -

Transfer to GF Capital Fund - Fire Truck 25,000 25,000 25,000 25,000 18,750 6,250 25,000 25,000 - - - -

TOTAL EXPENDITURES 3,161,215 3,222,120 4,043,000 4,025,381 2,585,005 1,190,829 3,775,834 4,014,606 (249,547) 238,772 (10,775) 0%

68% 32% 100%

REVENUE OVER EXPENDITURES 628,579 702,087 (207,766) (92,207) 1,004,733 (800,364) 204,369 0 296,576 (204,369) 92,207

Prior period adj's to Fund Balance

ENDING FUND BALANCE 1,369,771 2,071,858 1,842,092 1,705,885 1,004,733 (800,364) 2,002,461 2,002,461