Page 86 - FY 2024-25 ADOPTED BUDGET

P. 86

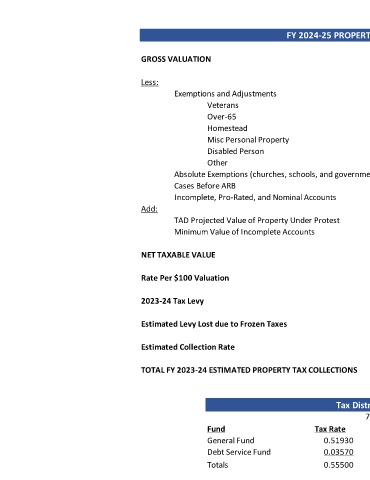

FY 2024-25 PROPERTY TAX CALCULATION

GROSS VALUATION $ 3,870,073,272

Less:

Exemptions and Adjustments

Veterans 56,951,403

Over-65 87,777,699

Homestead 32,503,074

Misc Personal Property 11,342,351

Disabled Person 267,500

Other 187,532

Absolute Exemptions (churches, schools, and government) 125,669,457

Cases Before ARB 59,512,227

Incomplete, Pro-Rated, and Nominal Accounts 39,807,574

Add:

TAD Projected Value of Property Under Protest 40,920,106

Minimum Value of Incomplete Accounts 25,202,339

NET TAXABLE VALUE $ 3,522,176,900

Rate Per $100 Valuation $ 0.55500

2023-24 Tax Levy $ 19,548,082

Estimated Levy Lost due to Frozen Taxes 794,655

Estimated Collection Rate 99%

TOTAL FY 2023-24 ESTIMATED PROPERTY TAX COLLECTIONS $ 18,565,893

Tax Distribution

72 Estimated

Fund Tax Rate Percentage Levy

General Fund 0.51930 93.57% $ 17,371,654

Debt Service Fund 0.03570 6.43% 1,194,238

Totals 0.55500 100.00% $ 18,565,893