Page 127 - FY 2024-25 ADOPTED BUDGET

P. 127

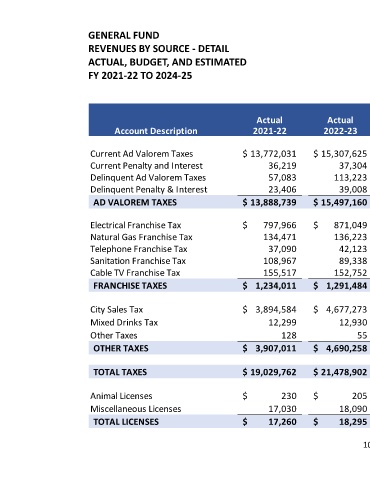

GENERAL FUND

REVENUES BY SOURCE - DETAIL

ACTUAL, BUDGET, AND ESTIMATED

FY 2021-22 TO 2024-25

Variance

Actual Actual Budget Estimated Favorable Budget

Account Description 2021-22 2022-23 2023-24 2023-24 (Unfavorable) 2024-25

Current Ad Valorem Taxes $ 13,772,031 $ 15,307,625 $ 16,109,743 $ 15,996,791 $ 1,375,363 $ 17,372,154

Current Penalty and Interest 36,219 37,304 30,000 40,000 (10,000) 30,000

Delinquent Ad Valorem Taxes 57,083 113,223 60,000 80,000 (10,000) 70,000

Delinquent Penalty & Interest 23,406 39,008 30,000 30,000 - 30,000

AD VALOREM TAXES $ 13,888,739 $ 15,497,160 $ 16,229,743 $ 16,146,791 $ 1,355,363 $ 17,502,154

Electrical Franchise Tax $ 797,966 $ 871,049 $ 850,000 $ 886,090 $ (36,090) $ 850,000

Natural Gas Franchise Tax 134,471 136,223 125,000 125,000 - 125,000

Telephone Franchise Tax 37,090 42,123 40,000 40,000 - 40,000

Sanitation Franchise Tax 108,967 89,338 100,000 100,000 - 100,000

Cable TV Franchise Tax 155,517 152,752 155,000 155,000 - 155,000

FRANCHISE TAXES $ 1,234,011 $ 1,291,484 $ 1,270,000 $ 1,306,090 $ (36,090) $ 1,270,000

City Sales Tax $ 3,894,584 $ 4,677,273 $ 4,000,000 $ 4,500,000 $ - $ 4,500,000

Mixed Drinks Tax 12,299 12,930 10,000 10,000 - 10,000

Other Taxes 128 55 - 50 (50) -

OTHER TAXES $ 3,907,011 $ 4,690,258 $ 4,010,000 $ 4,510,050 $ (50) $ 4,510,000

TOTAL TAXES $ 19,029,762 $ 21,478,902 $ 21,509,743 $ 21,962,931 $ 1,319,223 $ 23,282,154

Animal Licenses $ 230 $ 205 $ 300 $ 200 $ 100 $ 300

Miscellaneous Licenses 17,030 18,090 12,000 18,500 - 18,500

TOTAL LICENSES $ 17,260 $ 18,295 $ 12,300 $ 18,700 $ 100 $ 18,800

107