Page 305 - FY 2025 Adopted Operating Budget and Business Plan

P. 305

Appendices Return to Table of Contents

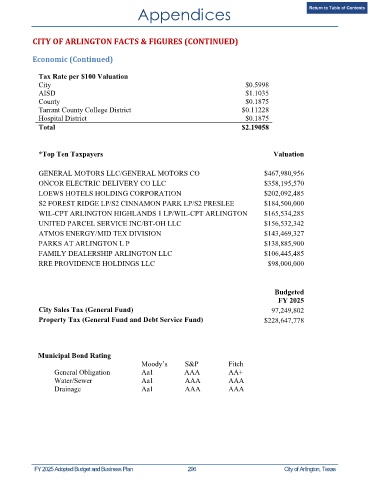

CITY OF ARLINGTON FACTS & FIGURES (CONTINUED)

Economic (Continued)

Tax Rate per $100 Valuation

City $0.5998

AISD $1.1035

County $0.1875

Tarrant County College District $0.11228

Hospital District $0.1875

Total $2.19058

*Top Ten Taxpayers Valuation

GENERAL MOTORS LLC/GENERAL MOTORS CO $467,980,956

ONCOR ELECTRIC DELIVERY CO LLC $358,195,570

LOEWS HOTELS HOLDING CORPORATION $202,092,485

S2 FOREST RIDGE LP/S2 CINNAMON PARK LP/S2 PRESLEE $184,500,000

WIL-CPT ARLINGTON HIGHLANDS 1 LP/WIL-CPT ARLINGTON $165,534,285

UNITED PARCEL SERVICE INC/BT-OH LLC $156,532,342

ATMOS ENERGY/MID TEX DIVISION $143,469,327

PARKS AT ARLINGTON L P $138,885,900

FAMILY DEALERSHIP ARLINGTON LLC $106,445,485

RRE PROVIDENCE HOLDINGS LLC $98,000,000

Budgeted

FY 2025

City Sales Tax (General Fund) 97,249,802

Property Tax (General Fund and Debt Service Fund) $228,647,778

Municipal Bond Rating

Moody’s S&P Fitch

General Obligation Aa1 AAA AA+

Water/Sewer Aa1 AAA AAA

Drainage Aa1 AAA AAA

FY 2025 Adopted Budget and Business Plan 296 City of Arlington, Texas