Page 31 - Southlake FY24 Budget

P. 31

Community

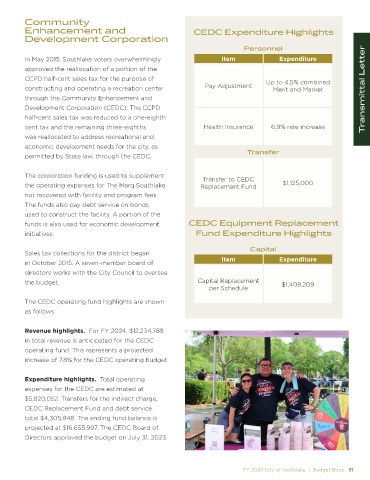

Enhancement and CEDC Expenditure Highlights

Development Corporation

Personnel

In May 2015, Southlake voters overwhelmingly Item Expenditure

approved the reallocation of a portion of the

CCPD half-cent sales tax for the purpose of Up to 4.5% combined

constructing and operating a recreation center Pay Adjustment Merit and Market Transmittal Letter

through the Community Enhancement and

Development Corporation (CEDC). The CCPD

half-cent sales tax was reduced to a one-eighth

cent tax and the remaining three-eighths Health Insurance 6.9% rate increase

was reallocated to address recreational and

economic development needs for the city, as

Transfer

permitted by State law, through the CEDC.

The corporation funding is used to supplement Transfer to CEDC

the operating expenses for The Marq Southlake Replacement Fund $1,125,000

not recovered with facility and program fees.

The funds also pay debt service on bonds

used to construct the facility. A portion of the

funds is also used for economic development CEDC Equipment Replacement

initiatives. Fund Expenditure Highlights

Capital

Sales tax collections for the district began

in October 2015. A seven-member board of Item Expenditure

directors works with the City Council to oversee

the budget. Capital Replacement $1,408,209

per Schedule

The CEDC operating fund highlights are shown

as follows:

Revenue highlights. For FY 2024, $12,234,788

in total revenue is anticipated for the CEDC

operating fund. This represents a projected

increase of 7.8% for the CEDC operating budget.

Expenditure highlights. Total operating

expenses for the CEDC are estimated at

$5,820,052. Transfers for the indirect charge,

CEDC Replacement Fund and debt service

total $4,305,948. The ending fund balance is

projected at $16,655,997. The CEDC Board of

Directors approved the budget on July 31, 2023.

FY 2024 City of Southlake | Budget Book 31