Page 277 - Southlake FY24 Budget

P. 277

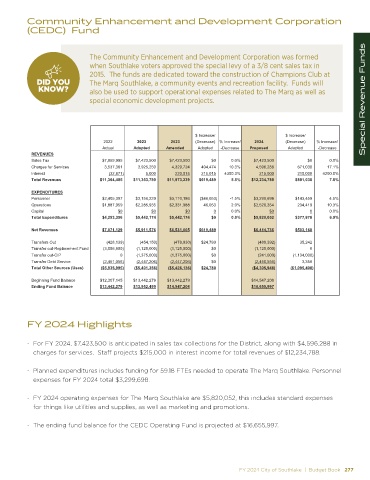

Community Enhancement and Development Corporation

(CEDC) Fund

The Community Enhancement and Development Corporation was formed

when Southlake voters approved the special levy of a 3/8 cent sales tax in

DID YOU 2015. The funds are dedicated toward the construction of Champions Club at

KNOW? The Marq Southlake, a community events and recreation facility. Funds will

DID YOU

KNOW? also be used to support operational expenses related to The Marq as well as

CEDC - OPERATING FUND

special economic development projects. Special Revenue Funds

Parks/Recreation

2024 Proposed and 2023 Revised Budget

$ Increase/ $ Increase/

2022 2023 2023 (Decrease) % Increase/ 2024 (Decrease) % Increase/

Actual Adopted Amended Adopted -Decrease Proposed Adopted -Decrease

REVENUES

Sales Tax $7,859,995 $7,423,500 $7,423,500 $0 0.0% $7,423,500 $0 0.0%

Charges for Services 3,537,361 3,925,250 4,329,724 404,474 10.3% 4,596,288 671,038 17.1%

Interest (32,871) 5,000 220,015 215,015 4300.3% 215,000 210,000 4200.0%

Total Revenues $11,364,485 $11,353,750 $11,973,239 $619,489 5.5% $12,234,788 $881,038 7.8%

EXPENDITURES

Personnel $2,405,397 $3,156,239 $3,110,186 ($46,053) -1.5% $3,299,698 $143,459 4.5%

Operations $1,887,959 $2,285,935 $2,331,988 46,053 2.0% $2,520,354 234,419 10.3%

Capital $0 $0 $0 0 0.0% $0 0 0.0%

Total Expenditures $4,293,356 $5,442,174 $5,442,174 $0 0.0% $5,820,052 $377,878 6.9%

Net Revenues $7,071,129 $5,911,576 $6,531,065 $619,489 $6,414,736 $503,160

Transfers Out (428,139) (454,150) (478,930) $24,780 (489,392) 35,242

Transfer out-Replacement Fund (3,056,800) (1,125,000) (1,125,000) $0 (1,125,000) 0

Transfer out-CIP 0 (1,375,000) (1,375,000) $0 (241,000) (1,134,000)

Transfer Debt Service (2,451,056) (2,447,206) (2,447,206) $0 (2,450,556) 3,350

Total Other Sources (Uses) ($5,935,995) ($5,401,356) ($5,426,136) $24,780 ($4,305,948) ($1,095,408)

Beginning Fund Balance $12,307,145 $13,442,279 $13,442,279 $14,547,208

Ending Fund Balance $13,442,279 $13,952,499 $14,547,208 $16,655,997

FY 2024 Highlights

- For FY 2024, $7,423,500 is anticipated in sales tax collections for the District, along with $4,596,288 in

charges for services. Staff projects $215,000 in interest income for total revenues of $12,234,788.

- Planned expenditures includes funding for 59.18 FTEs needed to operate The Marq Southlake. Personnel

expenses for FY 2024 total $3,299,698.

- FY 2024 operating expenses for The Marq Southlake are $5,820,052, this includes standard expenses

for things like utilities and supplies, as well as marketing and promotions.

- The ending fund balance for the CEDC Operating Fund is projected at $16,655,997.

FY 2024 City of Southlake | Budget Book 277