Page 264 - Southlake FY24 Budget

P. 264

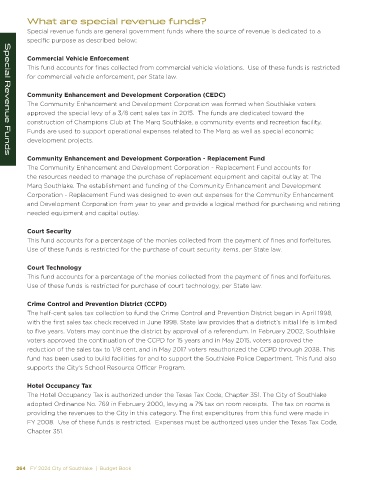

What are special revenue funds?

Special revenue funds are general government funds where the source of revenue is dedicated to a

specific purpose as described below:

Commercial Vehicle Enforcement

This fund accounts for fines collected from commercial vehicle violations. Use of these funds is restricted

for commercial vehicle enforcement, per State law.

Community Enhancement and Development Corporation (CEDC)

The Community Enhancement and Development Corporation was formed when Southlake voters

approved the special levy of a 3/8 cent sales tax in 2015. The funds are dedicated toward the

construction of Champions Club at The Marq Southlake, a community events and recreation facility.

Funds are used to support operational expenses related to The Marq as well as special economic

development projects.

Community Enhancement and Development Corporation - Replacement Fund

Special Revenue Funds

The Community Enhancement and Development Corporation - Replacement Fund accounts for

the resources needed to manage the purchase of replacement equipment and capital outlay at The

Marq Southlake. The establishment and funding of the Community Enhancement and Development

Corporation - Replacement Fund was designed to even out expenses for the Community Enhancement

and Development Corporation from year to year and provide a logical method for purchasing and retiring

needed equipment and capital outlay.

Court Security

This fund accounts for a percentage of the monies collected from the payment of fines and forfeitures.

Use of these funds is restricted for the purchase of court security items, per State law.

Court Technology

This fund accounts for a percentage of the monies collected from the payment of fines and forfeitures.

Use of these funds is restricted for purchase of court technology, per State law.

Crime Control and Prevention District (CCPD)

The half-cent sales tax collection to fund the Crime Control and Prevention District began in April 1998,

with the first sales tax check received in June 1998. State law provides that a district’s initial life is limited

to five years. Voters may continue the district by approval of a referendum. In February 2002, Southlake

voters approved the continuation of the CCPD for 15 years and in May 2015, voters approved the

reduction of the sales tax to 1/8 cent, and in May 2017 voters reauthorized the CCPD through 2038. This

fund has been used to build facilities for and to support the Southlake Police Department. This fund also

supports the City’s School Resource Officer Program.

Hotel Occupancy Tax

The Hotel Occupancy Tax is authorized under the Texas Tax Code, Chapter 351. The City of Southlake

adopted Ordinance No. 769 in February 2000, levying a 7% tax on room receipts. The tax on rooms is

providing the revenues to the City in this category. The first expenditures from this fund were made in

FY 2008. Use of these funds is restricted. Expenses must be authorized uses under the Texas Tax Code,

Chapter 351.

264 FY 2024 City of Southlake | Budget Book