Page 247 - Southlake FY24 Budget

P. 247

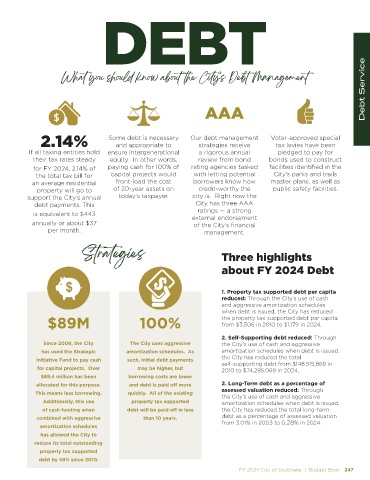

DEBT

Debt Service

What you should know about the City’s Debt Management

AAA

2.14% Some debt is necessary Our debt management Voter-approved special

strategies receive

and appropriate to

tax levies have been

If all taxing entities hold ensure intergenerational a rigorous annual pledged to pay for

their tax rates steady equity. In other words, review from bond bonds used to construct

for FY 2024, 2.14% of paying cash for 100% of rating agencies tasked facilities identified in the

the total tax bill for capital projects would with letting potential City’s parks and trails

an average residential front-load the cost borrowers know how master plans, as well as

property will go to of 20-year assets on credit-worthy the public safety facilities.

support the City’s annual today’s taxpayer. city is. Right now the

debt payments. This City has three AAA

ratings — a strong

is equivalent to $443 external endorsement

annually or about $37 of the City’s financial

per month. management.

Strategies Three highlights

about FY 2024 Debt

1. Property tax supported debt per capita

reduced: Through the City’s use of cash

and aggressive amortization schedules

when debt is issued, the City has reduced

$89M 100% the property tax supported debt per capita

from $3,506 in 2010 to $1,179 in 2024.

2. Self-Supporting debt reduced: Through

Since 2006, the City The City uses aggressive the City’s use of cash and aggressive

has used the Strategic amortization schedules. As amortization schedules when debt is issued,

the City has reduced the total

Initiative Fund to pay cash such, initial debt payments self-supporting debt from $148,515,869 in

for capital projects. Over may be higher, but 2010 to $74,285,069 in 2024.

$89.4 million has been borrowing costs are lower

allocated for this purpose. and debt is paid off more 2. Long-Term debt as a percentage of

This means less borrowing. quickly. All of the existing assessed valuation reduced: Through

the City’s use of cash and aggressive

Additionally, this use property tax supported amortization schedules when debt is issued,

of cash funding when debt will be paid off in less the City has reduced the total long-term

combined with aggressive than 10 years. debt as a percentage of assessed valuation

amortization schedules from 3.01% in 2003 to 0.28% in 2024.

has allowed the City to

reduce its total outstanding

property tax supported

debt by 59% since 2010.

FY 2024 City of Southlake | Budget Book 247