Page 126 - Southlake FY24 Budget

P. 126

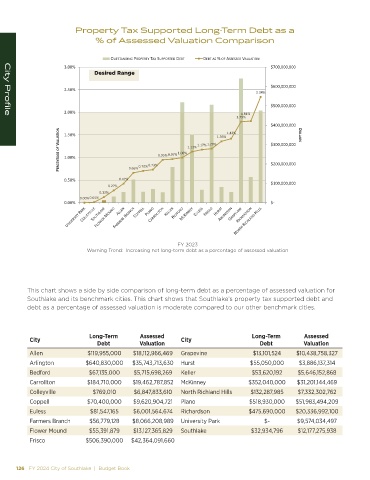

Property Tax Supported Long-Term Debt as a

% of Assessed Valuation Comparison

OUTSTANDING PROPERTY TAX SUPPORTED DEBT DEBT AS % OF ASSESSED VALUATION

3.00% $700,000,000

Desired Range

$600,000,000

2.50%

2.34%

$500,000,000

2.00% 1.81%

1.79%

City Profile

$400,000,000 DOLLARS

PERCENTAGE OF VALUATION 1.00% 0.73% 0.95% 0.97% 1.00% 1.13% 1.17% 1.20% $300,000,000

1.42%

1.50%

1.36%

$200,000,000

0.50% 0.42% 0.66% 0.70% $100,000,000

0.27%

0.13%

0.00% 0.01%

0.00% $-

FY 2023

Warning Trend: Increasing net long-term debt as a percentage of assessed valuation

This chart shows a side by side comparison of long-term debt as a percentage of assessed valuation for

Southlake and its benchmark cities. This chart shows that Southlake’s property tax supported debt and

debt as a percentage of assessed valuation is moderate compared to our other benchmark cities.

Long-Term Assessed Long-Term Assessed

City City

Debt Valuation Debt Valuation

Allen $119,955,000 $18,112,966,469 Grapevine $13,101,524 $10,438,758,327

Arlington $640,830,000 $35,743,713,630 Hurst $55,050,000 $3,886,137,314

Bedford $67,135,000 $5,715,698,269 Keller $53,620,192 $5,646,152,868

Carrollton $184,710,000 $19,462,787,852 McKinney $352,040,000 $31,201,144,469

Colleyville $769,010 $6,847,833,610 North Richland Hills $132,287,985 $7,332,302,762

Coppell $70,400,000 $9,620,904,721 Plano $518,930,000 $51,983,494,209

Euless $81,547,165 $6,001,564,674 Richardson $475,690,000 $20,336,992,100

Farmers Branch $56,779,128 $8,066,208,989 University Park $- $9,574,034,497

Flower Mound $55,391,879 $13,127,365,829 Southlake $32,934,796 $12,177,275,938

Frisco $506,390,000 $42,364,091,660

126 FY 2024 City of Southlake | Budget Book