Page 5 - RichlandHillsFY24ProposedBudget

P. 5

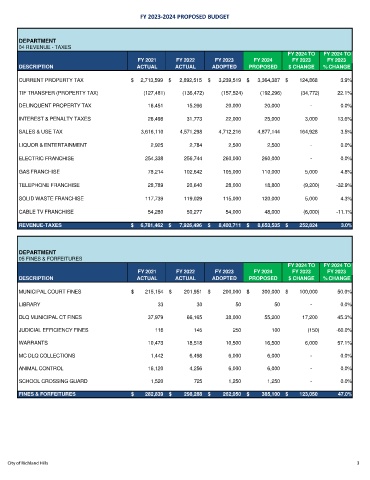

FY 2023-2024 PROPOSED BUDGET

DEPARTMENT

04 REVENUE - TAXES

FY 2024 TO FY 2024 TO

FY 2021 FY 2022 FY 2023 FY 2024 FY 2023 FY 2023

DESCRIPTION ACTUAL ACTUAL ADOPTED PROPOSED $ CHANGE % CHANGE

CURRENT PROPERTY TAX $ 2,713,599 $ 2,892,515 $ 3,239,519 $ 3,364,387 $ 124,868 3.9%

TIF TRANSFER (PROPERTY TAX) (127,481) (136,472) (157,524) (192,296) (34,772) 22.1%

DELINQUENT PROPERTY TAX 16,451 15,266 20,000 20,000 - 0.0%

INTEREST & PENALTY TAXES 26,498 31,773 22,000 25,000 3,000 13.6%

SALES & USE TAX 3,616,110 4,571,298 4,712,216 4,877,144 164,928 3.5%

LIQUOR & ENTERTAINMENT 2,925 2,784 2,500 2,500 - 0.0%

ELECTRIC FRANCHISE 254,338 256,744 260,000 260,000 - 0.0%

GAS FRANCHISE 78,214 102,642 105,000 110,000 5,000 4.8%

TELEPHONE FRANCHISE 28,789 20,640 28,000 18,800 (9,200) -32.9%

SOLID WASTE FRANCHISE 117,739 119,029 115,000 120,000 5,000 4.3%

CABLE TV FRANCHISE 54,280 50,277 54,000 48,000 (6,000) -11.1%

REVENUE-TAXES $ 6,781,462 $ 7,926,496 $ 8,400,711 $ 8,653,535 $ 252,824 3.0%

DEPARTMENT

05 FINES & FORFEITURES

FY 2024 TO FY 2024 TO

FY 2021 FY 2022 FY 2023 FY 2024 FY 2023 FY 2023

DESCRIPTION ACTUAL ACTUAL ADOPTED PROPOSED $ CHANGE % CHANGE

MUNICIPAL COURT FINES $ 215,154 $ 201,951 $ 200,000 $ 300,000 $ 100,000 50.0%

LIBRARY 33 30 50 50 - 0.0%

DLQ MUNICIPAL CT FINES 37,979 66,165 38,000 55,200 17,200 45.3%

JUDICIAL EFFICIENCY FINES 118 145 250 100 (150) -60.0%

WARRANTS 10,473 18,518 10,500 16,500 6,000 57.1%

MC DLQ COLLECTIONS 1,442 6,498 6,000 6,000 - 0.0%

ANIMAL CONTROL 16,120 4,256 6,000 6,000 - 0.0%

SCHOOL CROSSING GUARD 1,520 725 1,250 1,250 - 0.0%

FINES & FORFEITURES $ 282,839 $ 298,288 $ 262,050 $ 385,100 $ 123,050 47.0%

City of Richland Hills 3