Page 17 - RichlandHillsFY24ProposedBudget

P. 17

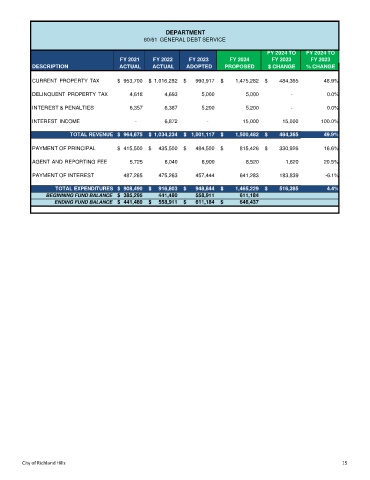

DEPARTMENT

60/61 GENERAL DEBT SERVICE

FY 2024 TO FY 2024 TO

FY 2021 FY 2022 FY 2023 FY 2024 FY 2023 FY 2023

DESCRIPTION ACTUAL ACTUAL ADOPTED PROPOSED $ CHANGE % CHANGE

CURRENT PROPERTY TAX $ 953,700 $ 1,016,282 $ 990,917 $ 1,475,282 $ 484,365 48.9%

DELINQUENT PROPERTY TAX 4,618 4,693 5,000 5,000 - 0.0%

INTEREST & PENALTIES 6,357 6,387 5,200 5,200 - 0.0%

INTEREST INCOME - 6,872 - 15,000 15,000 100.0%

TOTAL REVENUE $ 964,675 $ 1,034,234 $ 1,001,117 $ 1,500,482 $ 484,365 49.9%

PAYMENT OF PRINCIPAL $ 415,500 $ 435,500 $ 484,500 $ 815,426 $ 330,926 16.6%

AGENT AND REPORTING FEE 5,725 6,040 6,900 8,520 1,620 20.5%

PAYMENT OF INTEREST 487,265 475,263 457,444 641,283 183,839 -6.1%

TOTAL EXPENDITURES $ 908,490 $ 916,803 $ 948,844 $ 1,465,229 $ 516,385 4.4%

BEGINNING FUND BALANCE $ 385,295 441,480 558,911 611,184

ENDING FUND BALANCE $ 441,480 $ 558,911 $ 611,184 $ 646,437

City of Richland Hills 15