Page 7 - KennedaleFY24AdoptedBudget

P. 7

City of Kennedale

Fiscal Year 2023/2024

Adopted Budget

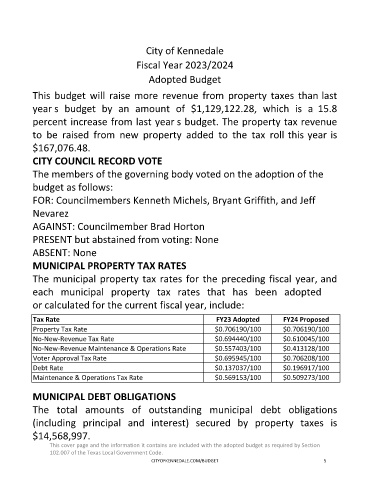

This budget will raise more revenue from property taxes tha last

year's budget by an amount of $1,129,122.28 15.8

budget. ta revenue

to be raised from new property added to the tax is

$167,076.48.

CITY COUNCIL RECORD VOTE

The members of the governing body voted on the adoption of the

budget as follows:

FOR: Councilmembers Kenneth Michels, Bryant Griffith, and Jeff

Nevarez

AGAINST: Councilmember Brad Horton

PRESENT but abstained from voting: None

ABSENT: None

MUNICIPAL PROPERTY TAX RATES

year, and

or calculated for the current fiscal year, include:

Tax Rate FY23 Adopted FY24 Proposed

Property Tax Rate $0.706190/100 $0.706190/100

No-New-Revenue Tax Rate $0.694440/100 $0.610045/100

No-New-Revenue Maintenance & Operations Rate $0.557403/100 $0.413128/100

Voter Approval Tax Rate $0.695945/100 $0.706208/100

Debt Rate $0.137037/100 $0.196917/100

Maintenance & Operations Tax Rate $0.569153/100 $0.509273/100

MUNICIPAL DEBT OBLIGATIONS

obligations

is

$14,568,997.

This cover page and the information it contains are included with the adopted budget as required by Section

102.007 of the Texas Local Government Code.

CITYOFKENNEDALE.COM/BUDGET 5