Page 134 - KennedaleFY24AdoptedBudget

P. 134

Form 50-212

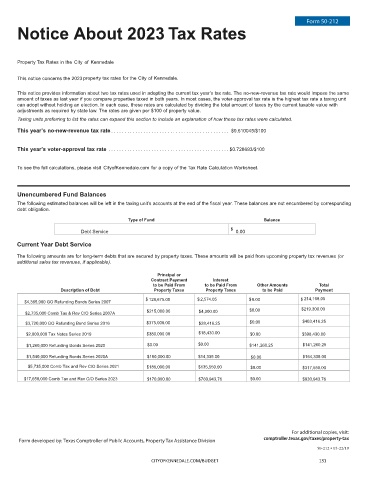

Notice About 2023 Tax Rates

Property Tax Rates in Kennedale

This notice concerns the 2023 property tax rates for the City of Kennedale.

This notice provides information about two tax rates used in adopting the current tax year’s tax rate. The no-new-revenue tax rate would Impose the same

amount of taxes as last year if you compare properties taxed in both years. In most cases, the voter-approval tax rate is the highest tax rate a taxing unit

can adopt without holding an election. In each case, these rates are calculated by dividing the total amount of taxes by the current taxable value with

adjustments as required by state law. The rates are given per $100 of property value.

Taxing units preferring to list the rates can expand this section to include an explanation of how these tax rates were calculated.

This year’s no-new-revenue tax rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $0.610045/$100

This year’s voter-approval tax rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $0.728693/$100

To see the full calculations, please visit CityofKennedale.com for a copy of the Tax Rate Calculation Worksheet.

Unencumbered Fund Balances

The following estimated balances will be left in the taxing unit’s accounts at the end of the fiscal year. These balances are not encumbered by corresponding

debt obligation.

Type of Fund Balance

$

Debt Service 0.00

Current Year Debt Service

The following amounts are for long-term debts that are secured by property taxes. These amounts will be paid from upcoming property tax revenues (or

additional sales tax revenues, if applicable).

Principal or

Contract Payment Interest

to be Paid From to be Paid From Other Amounts Total

Description of Debt Property Taxes Property Taxes to be Paid Payment

$ 129,675.00 $ 2,574.05 $0.00 $ 214,168.05

$4,365,000 GO Refunding Bonds Series 2007

$2,735,000 Comb Tax & Rev C/O Series 2007A $215,000.00 $4,300.00 $0.00 $219,300.00

$3,720,000 GO Refunding Bond Series 2016 $375,000.00 $28,416.25 $0.00 $403,416.25

$2,000,000 Tax Notes Series 2019 $380,000.00 $18,430.00 $0.00 $398,430.00

$1,260,000 Refunding Bonds Series 2020 $0.00 $0.00 $141,260.25 $141,260.25

$1,540,000 Refunding Bonds Series 2020A $150,000.00 $14,335.00 $0.00 $164,335.00

$5,735,000 Comb Tax and Rev C/O Series 2021 $185,000.00 $135,550.00 $0.00 $317,550.00

$17,650,000 Comb Tax and Rev C/O Series 2023 $170,000.00 $760,943,76 $0.00 $930,943.76

For additional copies, visit:

Form developed by: Texas Comptroller of Public Accounts, Property Tax Assistance Division comptroller.texas.gov/taxes/property-tax

50-212 • 05-22/19

CITYOFKENNEDALE.COM/BUDGET 131