Page 97 - FY 24 Budget Forecast at Adoption.xlsx

P. 97

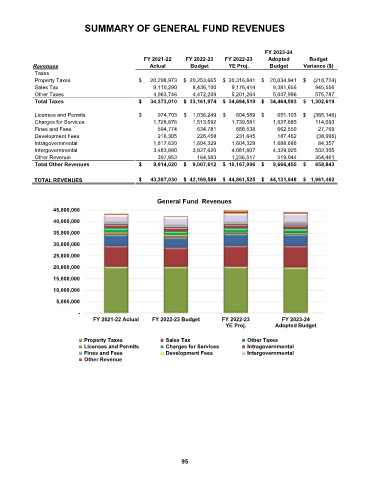

SUMMARY OF GENERAL FUND REVENUES

FY 2023-24

FY 2021-22 FY 2022-23 FY 2022-23 Adopted Budget

Revenues Actual Budget YE Proj. Budget Variance ($)

Taxes

Property Taxes $ 20,298,973 $ 20,253,665 $ 20,316,841 $ 20,034,941 $ (218,724)

Sales Tax 9,110,290 8,436,100 9,176,414 9,381,656 945,556

Other Taxes 4,963,746 4,472,209 5,201,264 5,047,996 575,787

Total Taxes $ 34,373,010 $ 33,161,974 $ 34,694,519 $ 34,464,593 $ 1,302,619

Licenses and Permits $ 974,703 $ 1,036,249 $ 604,589 $ 651,103 $ (385,146)

Charges for Services 1,728,876 1,513,592 1,739,581 1,627,685 114,093

Fines and Fees 594,774 634,781 668,538 662,550 27,769

Development Fees 216,305 226,458 231,645 187,462 (38,996)

Intragovernmental 1,617,630 1,604,329 1,604,329 1,688,686 84,357

Intergovernmental 3,483,880 3,827,620 4,081,807 4,329,925 502,305

Other Revenue 397,853 164,583 1,236,517 519,044 354,461

Total Other Revenues $ 9,014,020 $ 9,007,612 $ 10,167,006 $ 9,666,455 $ 658,843

TOTAL REVENUES $ 43,387,030 $ 42,169,586 $ 44,861,525 $ 44,131,048 $ 1,961,462

General Fund Revenues

45,000,000

40,000,000

35,000,000

30,000,000

25,000,000

20,000,000

15,000,000

10,000,000

5,000,000

-

FY 2021-22 Actual FY 2022-23 Budget FY 2022-23 FY 2023-24

YE Proj. Adopted Budget

Property Taxes Sales Tax Other Taxes

Licenses and Permits Charges for Services Intragovernmental

Fines and Fees Development Fees Intergovernmental

Other Revenue

95