Page 66 - FY 24 Budget Forecast at Adoption.xlsx

P. 66

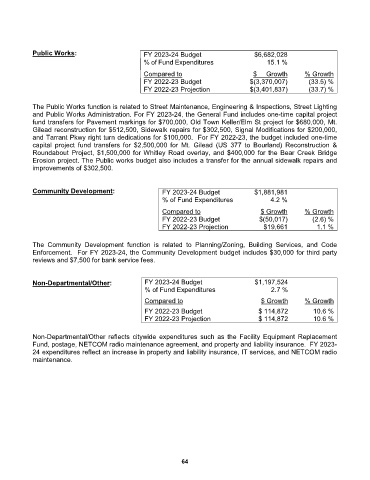

Public Works: FY 2023-24 Budget $6,682,028

% of Fund Expenditures 15.1 %

$ Growth

Compared to

% Growth

FY 2022-23 Budget $(3,370,007) (33.5) %

FY 2022-23 Projection $(3,401,837) (33.7) %

The Public Works function is related to Street Maintenance, Engineering & Inspections, Street Lighting

and Public Works Administration. For FY 2023-24, the General Fund includes one-time capital project

fund transfers for Pavement markings for $700,000, Old Town Keller/Elm St project for $680,000, Mt.

Gilead reconstruction for $512,500, Sidewalk repairs for $302,500, Signal Modifications for $200,000,

and Tarrant Pkwy right turn dedications for $100,000. For FY 2022-23, the budget included one-time

capital project fund transfers for $2,500,000 for Mt. Gilead (US 377 to Bourland) Reconstruction &

Roundabout Project, $1,500,000 for Whitley Road overlay, and $400,000 for the Bear Creek Bridge

Erosion project. The Public works budget also includes a transfer for the annual sidewalk repairs and

improvements of $302,500.

Community Development: FY 2023-24 Budget $1,881,981

% of Fund Expenditures 4.2 %

Compared to $ Growth % Growth

FY 2022-23 Budget $(50,017) (2.6) %

FY 2022-23 Projection $19,661 1.1 %

The Community Development function is related to Planning/Zoning, Building Services, and Code

Enforcement. For FY 2023-24, the Community Development budget includes $30,000 for third party

reviews and $7,500 for bank service fees.

Non-Departmental/Other: FY 2023-24 Budget $1,197,524

% of Fund Expenditures 2.7 %

Compared to $ Growth % Growth

FY 2022-23 Budget $ 114,872 10.6 %

FY 2022-23 Projection $ 114,872 10.6 %

Non-Departmental/Other reflects citywide expenditures such as the Facility Equipment Replacement

Fund, postage, NETCOM radio maintenance agreement, and property and liability insurance. FY 2023-

24 expenditures reflect an increase in property and liability insurance, IT services, and NETCOM radio

maintenance.

64