Page 57 - FY 24 Budget Forecast at Adoption.xlsx

P. 57

Ad Valorem Taxes:

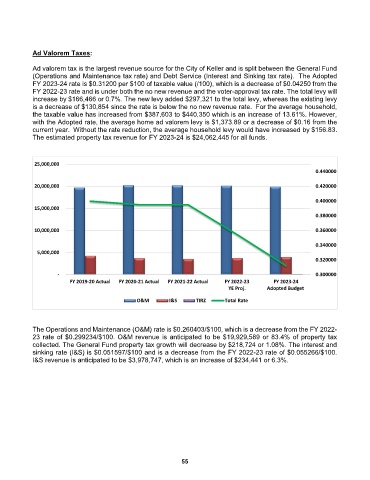

Ad valorem tax is the largest revenue source for the City of Keller and is split between the General Fund

(Operations and Maintenance tax rate) and Debt Service (Interest and Sinking tax rate). The Adopted

FY 2023-24 rate is $0.31200 per $100 of taxable value (/100), which is a decrease of $0.04250 from the

FY 2022-23 rate and is under both the no new revenue and the voter-approval tax rate. The total levy will

increase by $166,466 or 0.7%. The new levy added $297,321 to the total levy, whereas the existing levy

is a decrease of $130,854 since the rate is below the no new revenue rate. For the average household,

the taxable value has increased from $387,603 to $440,350 which is an increase of 13.61%. However,

with the Adopted rate, the average home ad valorem levy is $1,373.89 or a decrease of $0.16 from the

current year. Without the rate reduction, the average household levy would have increased by $156.83.

The estimated property tax revenue for FY 2023-24 is $24,062,445 for all funds.

25,000,000

0.440000

20,000,000 0.420000

0.400000

15,000,000

0.380000

10,000,000 0.360000

0.340000

5,000,000

0.320000

- 0.300000

FY 2019-20 Actual FY 2020-21 Actual FY 2021-22 Actual FY 2022-23 FY 2023-24

YE Proj. Adopted Budget

O&M I&S TIRZ Total Rate

The Operations and Maintenance (O&M) rate is $0.260403/$100, which is a decrease from the FY 2022-

23 rate of $0.299234/$100. O&M revenue is anticipated to be $19,929,589 or 83.4% of property tax

collected. The General Fund property tax growth will decrease by $218,724 or 1.08%. The interest and

sinking rate (I&S) is $0.051597/$100 and is a decrease from the FY 2022-23 rate of $0.055266/$100.

I&S revenue is anticipated to be $3,978,747, which is an increase of $234,441 or 6.3%.

55