Page 47 - City of Fort Worth Budget Book

P. 47

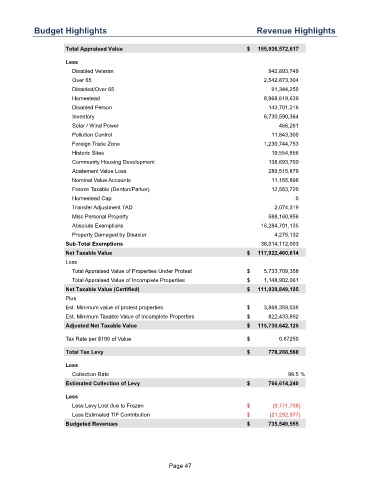

Budget Highlights Revenue Highlights

Total Appraised Value $ 155,936,572,617

Less

Disabled Veteran 942,893,749

Over 65 2,542,873,304

Disabled/Over 65 91,344,250

Homestead 8,968,619,639

Disabled Person 143,701,216

Inventory 6,730,590,364

Solar / Wind Power 466,261

Pollution Control 11,843,300

Foreign Trade Zone 1,230,744,753

Historic Sites 19,554,856

Community Housing Development 138,693,709

Abatement Value Loss 289,515,879

Nominal Value Accounts 11,165,898

Freeze Taxable (Denton/Parker) 12,583,720

Homestead Cap 0

Transfer Adjustment TAD 2,074,319

Misc Personal Property 588,160,956

Absolute Exemptions 16,284,701,135

Property Damaged by Disaster 4,275,132

Sub-Total Exemptions 38,014,112,003

Net Taxable Value $ 117,922,460,614

Less

Total Appraised Value of Properties Under Protest $ 5,733,709,358

Total Appraised Value of Incomplete Properties $ 1,148,902,061

Net Taxable Value (Certified) $ 111,039,849,195

Plus

Est. Minimum value of protest properties $ 3,868,359,038

Est. Minimum Taxable Value of Incomplete Properties $ 822,433,892

Adjusted Net Taxable Value $ 115,730,642,125

Tax Rate per $100 of Value $ 0.67250

Total Tax Levy $ 778,288,568

Less

Collection Rate 98.5 %

Estimated Collection of Levy $ 766,614,240

Less

Less Levy Lost due to Frozen $ (9,771,708)

Less Estimated TIF Contribution $ (21,292,977)

Budgeted Revenues $ 735,549,555

Page 47