Page 199 - City of Fort Worth Budget Book

P. 199

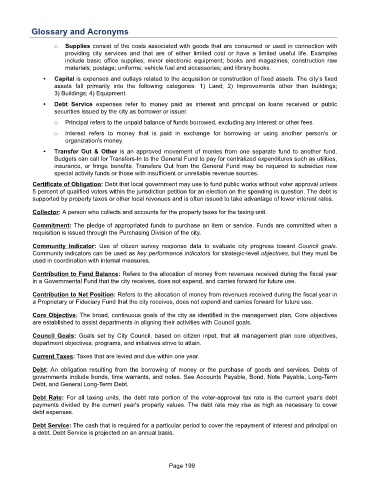

Glossary and Acronyms

○ Supplies consist of the costs associated with goods that are consumed or used in connection with

providing city services and that are of either limited cost or have a limited useful life. Examples

include basic office supplies; minor electronic equipment; books and magazines; construction raw

materials; postage; uniforms; vehicle fuel and accessories; and library books.

• Capital is expenses and outlays related to the acquisition or construction of fixed assets. The city’s fixed

assets fall primarily into the following categories: 1) Land; 2) Improvements other than buildings;

3) Buildings; 4) Equipment.

• Debt Service expenses refer to money paid as interest and principal on loans received or public

securities issued by the city as borrower or issuer.

○ Principal refers to the unpaid balance of funds borrowed, excluding any interest or other fees.

○ Interest refers to money that is paid in exchange for borrowing or using another person's or

organization's money.

• Transfer Out & Other is an approved movement of monies from one separate fund to another fund.

Budgets can call for Transfers-In to the General Fund to pay for centralized expenditures such as utilities,

insurance, or fringe benefits. Transfers Out from the General Fund may be required to subsidize new

special activity funds or those with insufficient or unreliable revenue sources.

Certificate of Obligation: Debt that local government may use to fund public works without voter approval unless

5 percent of qualified voters within the jurisdiction petition for an election on the spending in question. The debt is

supported by property taxes or other local revenues and is often issued to take advantage of lower interest rates.

Collector: A person who collects and accounts for the property taxes for the taxing unit.

Commitment: The pledge of appropriated funds to purchase an item or service. Funds are committed when a

requisition is issued through the Purchasing Division of the city.

Community Indicator: Use of citizen survey response data to evaluate city progress toward Council goals.

Community indicators can be used as key performance indicators for strategic-level objectives, but they must be

used in coordination with internal measures.

Contribution to Fund Balance: Refers to the allocation of money from revenues received during the fiscal year

in a Governmental Fund that the city receives, does not expend, and carries forward for future use.

Contribution to Net Position: Refers to the allocation of money from revenues received during the fiscal year in

a Proprietary or Fiduciary Fund that the city receives, does not expend and carries forward for future use.

Core Objective: The broad, continuous goals of the city as identified in the management plan. Core objectives

are established to assist departments in aligning their activities with Council goals.

Council Goals: Goals set by City Council, based on citizen input, that all management plan core objectives,

department objectives, programs, and initiatives strive to attain.

Current Taxes: Taxes that are levied and due within one year.

Debt: An obligation resulting from the borrowing of money or the purchase of goods and services. Debts of

governments include bonds, time warrants, and notes. See Accounts Payable, Bond, Note Payable, Long-Term

Debt, and General Long-Term Debt.

Debt Rate: For all taxing units, the debt rate portion of the voter-approval tax rate is the current year's debt

payments divided by the current year's property values. The debt rate may rise as high as necessary to cover

debt expenses.

Debt Service: The cash that is required for a particular period to cover the repayment of interest and principal on

a debt. Debt Service is projected on an annual basis.

Page 199