Page 120 - City of Fort Worth Budget Book

P. 120

Special Revenue Fund Alliance Maintenance Facility

FUND SUMMARY

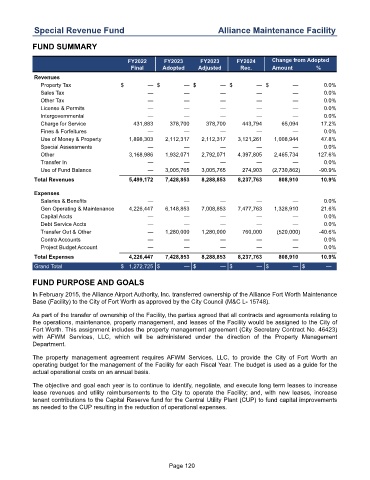

FY2022 FY2023 FY2023 FY2024 Change from Adopted

Final Adopted Adjusted Rec. Amount %

Revenues

Property Tax $ — $ — $ — $ — $ — 0.0 %

Sales Tax — — — — — 0.0 %

Other Tax — — — — — 0.0 %

License & Permits — — — — — 0.0 %

Intergovernmental — — — — — 0.0 %

Charge for Service 431,883 378,700 378,700 443,794 65,094 17.2 %

Fines & Forfeitures — — — — — 0.0 %

Use of Money & Property 1,898,303 2,112,317 2,112,317 3,121,261 1,008,944 47.8 %

Special Assessments — — — — — 0.0 %

Other 3,168,986 1,932,071 2,792,071 4,397,805 2,465,734 127.6 %

Transfer In — — — — — 0.0 %

Use of Fund Balance — 3,005,765 3,005,765 274,903 (2,730,862) -90.9 %

Total Revenues 5,499,172 7,428,853 8,288,853 8,237,763 808,910 10.9 %

Expenses

Salaries & Benefits — — — — — 0.0 %

Gen Operating & Maintenance 4,226,447 6,148,853 7,008,853 7,477,763 1,328,910 21.6 %

Capital Accts — — — — — 0.0 %

Debt Service Accts — — — — — 0.0 %

Transfer Out & Other — 1,280,000 1,280,000 760,000 (520,000) -40.6 %

Contra Accounts — — — — — 0.0 %

Project Budget Account — — — — — 0.0 %

Total Expenses 4,226,447 7,428,853 8,288,853 8,237,763 808,910 10.9 %

Grand Total $ 1,272,725 $ — $ — $ — $ — $ —

FUND PURPOSE AND GOALS

In February 2015, the Alliance Airport Authority, Inc. transferred ownership of the Alliance Fort Worth Maintenance

Base (Facility) to the City of Fort Worth as approved by the City Council (M&C L- 15748).

As part of the transfer of ownership of the Facility, the parties agreed that all contracts and agreements relating to

the operations, maintenance, property management, and leases of the Facility would be assigned to the City of

Fort Worth. This assignment includes the property management agreement (City Secretary Contract No. 46423)

with AFWM Services, LLC, which will be administered under the direction of the Property Management

Department.

The property management agreement requires AFWM Services, LLC, to provide the City of Fort Worth an

operating budget for the management of the Facility for each Fiscal Year. The budget is used as a guide for the

actual operational costs on an annual basis.

The objective and goal each year is to continue to identify, negotiate, and execute long term leases to increase

lease revenues and utility reimbursements to the City to operate the Facility; and, with new leases, increase

tenant contributions to the Capital Reserve fund for the Central Utility Plant (CUP) to fund capital improvements

as needed to the CUP resulting in the reduction of operational expenses.

Page 120