Page 53 - Euless ORD 2360 Adopted FY 23-24 Budget

P. 53

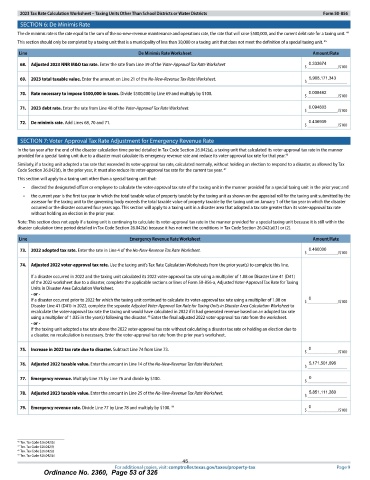

2023 Tax Rate Calculation Worksheet— Taxing Units Other Than School Districts or Water Districts Form 50- 856

The de minimis rate is the rate equal to the sum of the no -new - revenue maintenance and operations rate, the rate that will raise $ 500, 000, and the current debt rate for a taxing unit. 44

This section should only be completed by a taxing unit that is a municipality of less than 30,000 or a taxing unit that does not meet the definition of a special taxing unit. 41

e Minimis Rate Works

68. Adjusted 2023 NNR M& O tax rate. Enter the rate from Line 39 of the Voter -Approval Tax Rate Worksheet $ 0. 333674 /$

100

69. 2023 total taxable value. Enter the amount on Line 21 of the No -New -Revenue Tax Rate Worksheet. $ 5, 908, 171, 343

70. Rate necessary to impose $ 500, 000 in taxes. Divide $ 500,000 by Line 69 and multiply by $ 100. $ 0. 008462 /$ 100

2023 debt rate. Enter the rate from Line 48 of the Voter -Approval Tax Rate Worksheet. $ 0. 094803 /$

71.

100

72. De minimis rate. Add Lines 68, 70 and 71. $ 0. 436939 /$

100

In the tax year after the end of the disaster calculation time period detailed in Tax Code Section 26.042( a), a taxing unit that calculated its voter -approval tax rate in the manner

provided for a special taxing unit due to a disaster must calculate its emergency revenue rate and reduce its voter -approval tax rate for that year.'

Similarly, if a taxing unit adopted a tax rate that exceeded its voter -approval tax rate, calculated normally, without holding an election to respond to a disaster, as allowed by Tax

Code Section 26.042(d), in the prior year, it must also reduce its voter -approval tax rate for the current tax year. 47

This section will apply to a taxing unit other than a special taxing unit that:

directed the designated officer or employee to calculate the voter -approval tax rate of the taxing unit in the manner provided for a special taxing unit in the prior year; and

the current year is the first tax year in which the total taxable value of property taxable by the taxing unit as shown on the appraisal roll for the taxing unit submitted by the

assessor for the taxing unit to the governing body exceeds the total taxable value of property taxable by the taxing unit on January 1 of the tax year in which the disaster

occurred or the disaster occurred four years ago. This section will apply to a taxing unit in a disaster area that adopted a tax rate greater than its voter -approval tax rate

without holding an election in the prior year.

Note: This section does not apply if a taxing unit is continuing to calculate its voter -approval tax rate in the manner provided for a special taxing unit because it is still within the

disaster calculation time period detailed in Tax Code Section 26.042(a) because it has not met the conditions in Tax Code Section 26.042(a)( 1) or (2).

mergency Revenue Rate Worksh

72022 adopted tax rate. Enter the rate in Line 4 of the No -New -Revenue Tax Rate Worksheet $ 0. 460000 /$ 100

74. Adjusted 2022 voter -approval tax rate. Use the taxing unit' sTax Rate Calculation Worksheets from the prior year(s) to complete this line.

If a disaster occurred in 2022 and the taxing unit calculated its 2022 voter -approval tax rate using a multiplier of 1. 08 on Disaster Line 41 ( D41)

of the 2022 worksheet due to a disaster, complete the applicable sections or lines of Form 50- 856-a, Adjusted Voter -Approval Tax Rate for Taxing

Units in Disaster Area Calculation Worksheet.

or -

0 /$

If a disaster occurred prior to 2022 for which the taxing unit continued to calculate its voter -approval tax rate using a multiplier of 1. 08 on $

100

Disaster Line 41 ( D41) in 2022, complete the separate Adjusted Voter - Approval Tax Rate for Taxing Units in Disaster Area Calculation Worksheet to

recalculate the voter -approval tax rate the taxing unit would have calculated in 2022 if it had generated revenue based on an adopted tax rate

using a multiplier of 1. 035 in the year( s) following the disaster. 48 Enter the final adjusted 2022 voter -approval tax rate from the worksheet.

or-

If the taxing unit adopted a tax rate above the 2022 voter -approval tax rate without calculating a disaster tax rate or holding an election due to

a disaster, no recalculation is necessary. Enter the voter -approval tax rate from the prior year' s worksheet.

75. Increase in 2022 tax rate due to disaster. Subtract Line 74 from Line 73. 0

100

76. Adjusted 2022 taxable value. Enter the amount in Line 14 of the No -New -Revenue Tax Rate Worksheet. 5, 171, 501, 696

77. Emergency revenue. Multiply Line 75 by Line 76 and divide by $ 100. 0

S

78. Adjusted 2023 taxable value. Enter the amount in Line 25 of the No -New -Revenue Tax Rate Worksheet. 5, 851, 111, 280

79. Emergency revenue rate. Divide Line 77 by Line 78 and multiply by $ 100. 49 0

100

Tex. Tax Code § 26.042( b)

Tex. Tax Code § 26.042( f)

Tex. Tax Code § 26.042( c)

9 Tex. Tax Code § 26. 042( b)

45

For additional copies, visit: comptroller.texas. gov/ taxes/ property-tax Page 9

Ordinance No. 2360, Page 53 of 326