Page 29 - Euless ORD 2360 Adopted FY 23-24 Budget

P. 29

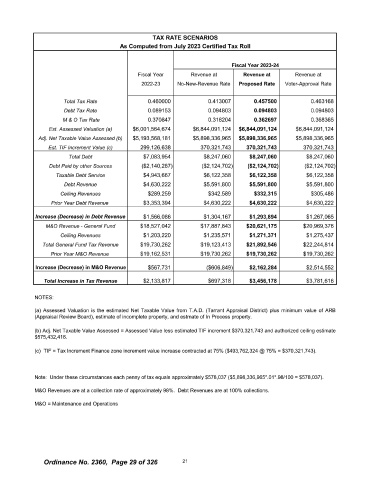

TAX RATE SCENARIOS

As Computed from July 2023 Certified Tax Roll

Fiscal Year 2023- 24

Fiscal Year Revenue at Revenue at Revenue at

2022- 23 No -New -Revenue Rate Proposed Rate Voter -Approval Rate

Total Tax Rate 0. 460000 0. 413007 0. 457500 0. 463168

Debt Tax Rate 0. 089153 0. 094803 0. 094803 0. 094803

M & O Tax Rate 0. 370847 0. 318204 0. 362697 0. 368365

Est. Assessed Valuation ( a) 6, 001, 564, 674 6, 844, 091, 124 6, 844, 091, 124 6, 844, 091, 124

Adj. Net Taxable Value Assessed ( b) 5, 193, 568, 181 5, 898, 336, 965 5, 898, 336, 965 5, 898, 336, 965

Est. TIF Increment Value ( c) 299, 126, 638 370, 321, 743 370, 321, 743 370, 321, 743

Total Debt 7, 083, 954 8, 247, 060 8, 247, 060 8, 247, 060

Debt Paid by other Sources 2, 140, 287) 2, 124, 702) 2, 124, 702) 2, 124, 702)

Taxable Debt Service 4, 943, 667 6, 122, 358 6, 122, 358 6, 122, 358

Debt Revenue 4, 630, 222 5, 591, 800 5, 591, 800 5, 591, 800

Ceiling Revenues 289, 259 342, 589 332, 315 305, 486

Prior Year Debt Revenue 3, 353, 394 4, 630, 222 4, 630, 222 4, 630, 222

Increase ( Decrease) in Debt Revenue 1, 566, 086 1, 304, 167 1, 293, 894 1, 267, 065

M& O Revenue - General Fund 18, 527, 042 17, 887, 843 20, 621, 175 20, 969, 376

Ceiling Revenues 1, 203, 220 1, 235, 571 1, 271, 371 1, 275, 437

Total General Fund Tax Revenue 19, 730, 262 19, 123, 413 21, 892, 546 22, 244, 814

Prior Year M& O Revenue 19, 162, 531 19, 730, 262 19, 730, 262 19, 730, 262

Increase ( Decrease) in M& O Revenue 567, 731 606, 849) 2, 162, 284 2, 514, 552

Total Increase in Tax Revenue $ 2, 133, 817 697, 318 $ 3, 456, 178 $ 3, 781, 616

NOTES:

a) Assessed Valuation is the estimated Net Taxable Value from T.A.D. ( Tarrant Appraisal District) plus minimum value of ARB

Appraisal Review Board), estimate of incomplete property, and estmate of In Process property.

b) Adj. Net Taxable Value Assessed = Assessed Value less estimated TIF increment $ 370, 321, 743 and authorized ceiling estimate

575,432,416.

c) TIF = Tax Increment Finance zone increment value increase contracted at 75% ($ 493, 762, 324 @ 75% = $ 370, 321, 743).

Note: Under these circumstances each penny of tax equals approximately $ 578, 037 ($ 5, 898, 336, 965'. 01'. 98/ 100 = $ 578, 037).

M& O Revenues are at a collection rate of approximately 98%. Debt Revenues are at 100% collections.

M& O = Maintenance and Operations

Ordinance No. 2360, Page 29 of 326 21