Page 260 - NEXT YEAR BUDGET DETAIL REPORT

P. 260

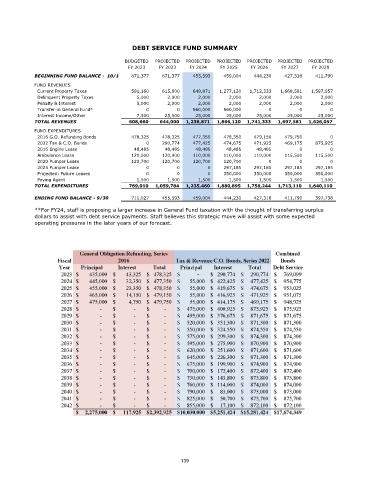

DEBT SERVICE FUND SUMMARY

BUDGETED PROJECTED PROJECTED PROJECTED PROJECTED PROJECTED PROJECTED

FY 2023 FY 2023 FY 2024 FY 2025 FY 2026 FY 2027 FY 2028

BEGINNING FUND BALANCE - 10/1 871,377 871,377 455,593 459,004 444,230 427,318 411,790

FUND REVENUES

Current Property Taxes 591,160 615,000 649,871 1,277,120 1,712,333 1,668,581 1,597,057

Delinquent Property Taxes 5,000 2,000 2,000 2,000 2,000 2,000 2,000

Penalty & Interest 5,000 2,000 2,000 2,000 2,000 2,000 2,000

Transfer-in General Fund* 0 0 560,000 560,000 0 0 0

Interest Income/Other 7,500 25,000 25,000 25,000 25,000 25,000 25,000

TOTAL REVENUES 608,660 644,000 1,238,871 1,866,120 1,741,333 1,697,581 1,626,057

FUND EXPENDITURES

2016 G.O. Refunding Bonds 478,325 478,325 477,350 478,350 479,150 479,750 0

2022 Tax & C.O. Bonds 0 290,774 477,425 474,675 471,925 469,175 875,925

2016 Engine Lease 48,485 48,485 48,485 48,485 48,485 0 0

Ambulance Lease 120,000 120,000 110,000 110,000 110,000 115,500 115,500

2020 Pumper Lease 120,700 120,700 120,700 120,700 0 0 0

2025 Pumper Lease 0 0 0 297,185 297,185 297,185 297,185

Projected: Future Leases 0 0 0 350,000 350,000 350,000 350,000

Paying Agent 1,500 1,500 1,500 1,500 1,500 1,500 1,500

TOTAL EXPENDITURES 769,010 1,059,784 1,235,460 1,880,895 1,758,244 1,713,110 1,640,110

ENDING FUND BALANCE - 9/30 711,027 455,593 459,004 444,230 427,318 411,790 397,738

**For FY24, staff is proposing a larger increase in General Fund taxation with the thought of transferring surplus

dollars to assist with debt service payments. Staff believes this strategic move will assist with some expected

operating pressures in the later years of our forecast.

139