Page 22 - Report

P. 22

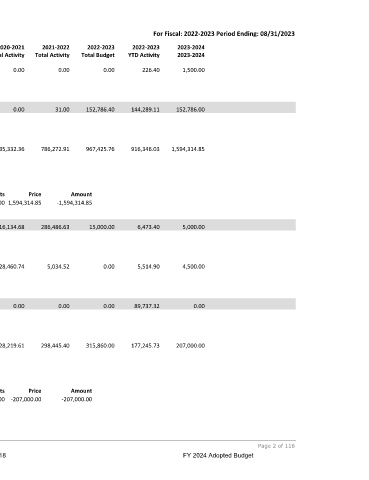

Budget Worksheet Condensed For Fiscal: 2022-2023 Period Ending: 08/31/2023

2020-2021 2021-2022 2022-2023 2022-2023 2023-2024

Total Activity Total Activity Total Budget YTD Activity 2023-2024

100-300-4050-00 Credit Card Processing Fee 0.00 0.00 0.00 226.40 1,500.00

100-300-4121-00 Trash Service 0.00 31.00 152,786.40 144,289.11 152,786.00

100-300-4210-00 Ad Valorem Taxes 835,332.36 786,272.91 967,425.76 916,346.03 1,594,314.85

Budget Detail

Budget Code Description Units Price Amount

2023-2024 Value of $252,623,461 at M&O rate of 1.00 -1,594,314.85 -1,594,314.85

$0.631098 (98.8% of $255,691,763).

100-300-4211-00 Ad Valorem Delinquent Taxes 16,134.68 286,486.63 15,000.00 6,473.40 5,000.00

100-300-4212-00 Ad Valorem Penalty and Interest 28,460.74 5,034.52 0.00 5,514.90 4,500.00

100-300-4213-00 Vehicle Inventory Tax Overage … 0.00 0.00 0.00 89,737.32 0.00

100-300-4220-00 City Sales Taxes 328,219.61 298,445.40 315,860.00 177,245.73 207,000.00

Budget Detail

Budget Code Description Units Price Amount

2023-2024 Based on FY 2023 downturn in taxes 1.00 -207,000.00 -207,000.00

8/4/2023 11:06:01 AM Page 2 of 116

9/18 FY 2024 Adopted Budget