Page 8 - FY 2023-24 ADOPTED BUDGET

P. 8

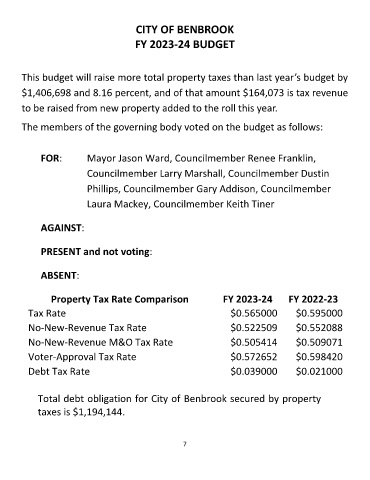

CITY OF BENBROOK

FY 2023-24 BUDGET

This budget will raise more total property taxes than last year’s budget by

$1,406,698 and 8.16 percent, and of that amount $164,073 is tax revenue

to be raised from new property added to the roll this year.

The members of the governing body voted on the budget as follows:

FOR: Mayor Jason Ward, Councilmember Renee Franklin,

Councilmember Larry Marshall, Councilmember Dustin

Phillips, Councilmember Gary Addison, Councilmember

Laura Mackey, Councilmember Keith Tiner

AGAINST:

PRESENT and not voting:

ABSENT:

Property Tax Rate Comparison FY 2023-24 FY 2022-23

Tax Rate $0.565000 $0.595000

No-New-Revenue Tax Rate $0.522509 $0.552088

No-New-Revenue M&O Tax Rate $0.505414 $0.509071

Voter-Approval Tax Rate $0.572652 $0.598420

Debt Tax Rate $0.039000 $0.021000

Total debt obligation for City of Benbrook secured by property

taxes is $1,194,144.

7