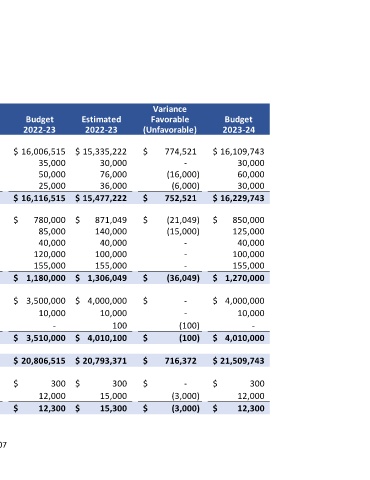

Page 128 - FY 2023-24 ADOPTED BUDGET

P. 128

GENERAL FUND

REVENUES BY SOURCE - DETAIL

ACTUAL, BUDGET, AND ESTIMATED

FY 2020-21 TO 2023-24

Variance

Actual Actual Budget Estimated Favorable Budget

Account Description 2020-21 2021-22 2022-23 2022-23 (Unfavorable) 2023-24

Current Ad Valorem Taxes $ 13,508,197 $ 13,987,564 $ 16,006,515 $ 15,335,222 $ 774,521 $ 16,109,743

Current Penalty and Interest 30,580 35,000 35,000 30,000 - 30,000

Delinquent Ad Valorem Taxes 53,805 50,000 50,000 76,000 (16,000) 60,000

Delinquent Penalty & Interest 28,869 20,000 25,000 36,000 (6,000) 30,000

AD VALOREM TAXES $ 13,621,450 $ 14,092,564 $ 16,116,515 $ 15,477,222 $ 752,521 $ 16,229,743

Electrical Franchise Tax $ 780,165 $ 780,000 $ 780,000 $ 871,049 $ (21,049) $ 850,000

Natural Gas Franchise Tax 111,801 85,000 85,000 140,000 (15,000) 125,000

Telephone Franchise Tax 42,544 40,000 40,000 40,000 - 40,000

Sanitation Franchise Tax 120,727 350,000 120,000 100,000 - 100,000

Cable TV Franchise Tax 153,727 155,000 155,000 155,000 - 155,000

FRANCHISE TAXES $ 1,208,965 $ 1,410,000 $ 1,180,000 $ 1,306,049 $ (36,049) $ 1,270,000

City Sales Tax $ 3,392,656 $ 3,250,000 $ 3,500,000 $ 4,000,000 $ - $ 4,000,000

Mixed Drinks Tax 9,748 4,500 10,000 10,000 - 10,000

Other Taxes 68 - - 100 (100) -

OTHER TAXES $ 3,402,472 $ 3,254,500 $ 3,510,000 $ 4,010,100 $ (100) $ 4,010,000

TOTAL TAXES $ 18,232,887 $ 18,757,064 $ 20,806,515 $ 20,793,371 $ 716,372 $ 21,509,743

Animal Licenses $ 255 $ 400 $ 300 $ 300 $ - $ 300

Miscellaneous Licenses 17,333 10,000 12,000 15,000 (3,000) 12,000

TOTAL LICENSES $ 17,588 $ 10,400 $ 12,300 $ 15,300 $ (3,000) $ 12,300

107