Page 19 - Bedford-FY23-24 Budget

P. 19

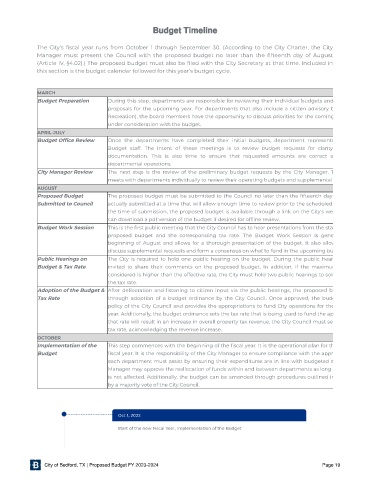

Budget Timeline

The City’s scal year runs from October 1 through September 30. (According to the City Charter, the City

Manager must present the Council with the proposed budget no later than the fteenth day of August

(Article IV, §4.02).) The proposed budget must also be led with the City Secretary at that time. Included in

this section is the budget calendar followed for this year’s budget cycle.

MARCH

During this step, departments are responsible for reviewing their individual budgets and

Budget Preparation

proposals for the upcoming year. For departments that also include a citizen advisory b

Recreation), the board members have the opportunity to discuss priorities for the coming

under consideration with the budget.

APRIL-JULY

Once the departments have completed their initial budgets, department representa

Budget Of{ce Review

Budget staff. The intent of these meetings is to review budget requests for clarity

documentation. This is also time to ensure that requested amounts are correct a

departmental operations.

The next step is the review of the preliminary budget requests by the City Manager. T

City Manager Review

meets with departments individually to review their operating budgets and supplemental

AUGUST

The proposed budget must be submitted to the Council no later than the fteenth day

Proposed Budget

actually submitted at a time that will allow enough time to review prior to the scheduled

Submitted to Council

the time of submission, the proposed budget is available through a link on the City's we

can download a pdf version of the budget if desired for of ine review.

This is the rst public meeting that the City Council has to hear presentations from the staf

Budget Work Session

proposed budget and the corresponding tax rate. The Budget Work Session is gene

beginning of August and allows for a thorough presentation of the budget. It also allow

discuss supplemental requests and form a consensus on what to fund in the upcoming bu

The City is required to hold one public hearing on the budget. During the public hear

Public Hearings on

invited to share their comments on the proposed budget. In addition, if the maximum

Budget & Tax Rate

considered is higher than the effective rate, the City must hold two public hearings to soli

the tax rate.

Adoption of the Budget & After deliberation and listening to citizen input via the public hearings, the proposed b

through adoption of a budget ordinance by the City Council. Once approved, the budg

Tax Rate

policy of the City Council and provides the appropriations to fund City operations for the

year. Additionally, the budget ordinance sets the tax rate that is being used to fund the ap

that rate will result in an increase in overall property tax revenue, the City Council must se

tax rate, acknowledging the revenue increase.

OCTOBER

This step commences with the beginning of the scal year. It is the operational plan for th

Implementation of the

scal year. It is the responsibility of the City Manager to ensure compliance with the appr

Budget

each department must assist by ensuring their expenditures are in line with budgeted a

Manager may approve the reallocation of funds within and between departments as long a

is not affected. Additionally, the budget can be amended through procedures outlined in

by a majority vote of the City Council.

O c t 1 , 2 0 2 2

S ta r t o f t h e n ew F i s c a l Yea r, I m p l e m e n ta t i o n o f t h e B u d g e t

City of Bedford, TX | Proposed Budget FY 2023-2024 Page 19